Introduction

The role of financial management help and capital budgeting plays an effective part in an organization. This financial management help highlights the importance of CAPM model and capital budgeting techniques like NPV (Yunus, 2013). Both these model are very much important for the purpose of organizations.

Part A: Analysis and Understanding of the Capital Asset Pricing Model

1.1 Capital Asset Pricing Model: Overview

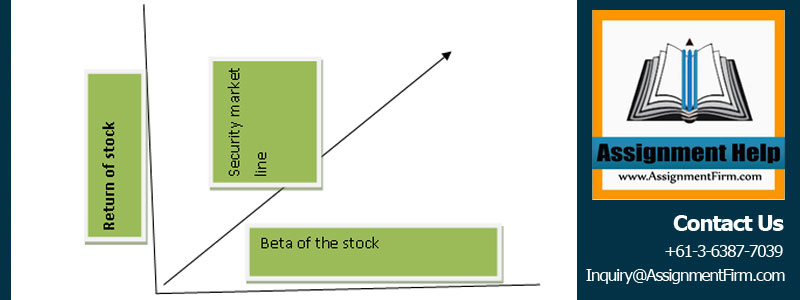

The Capital Asset Pricing Model is the most important element in the financial management of the modern business organizations. This model reflects the business relationship between risk and return of a portfolio of financial securities. With the help of capital asset pricing model, a business organization can calculate the expected return on a portfolio of various assets (Dempsey, 2012). The application of this model can only be done after the beta of a particular stock can be calculated. The formula for capital asset pricing model can be explained with the help of the following diagram:-

Return (Expected on a portfolio) = RF + (Rm – RF) * Beta, where RF = Risk-free rate of the current market, Rm = Return from the current market (Risk premium rate) (Web.stanford.edu, 2015).

To calculate the expected return of the portfolio, Beta of the stock needs to be calculated. Beta can be calculated with the help of the following formula:-

Beta on a portfolio = Covariance (Return on market and Return on a stock)/ Total variance of the portfolio market

Beta of the stock reflects the financial leverage on a particular portfolio of securities. For this reason, the capital asset pricing model includes the factor of beta (Nickisch, 2013).

There are several assumptions for Financial Management Help that have been implied in the capital asset pricing model. The assumptions are all the investors are risk averse investors and they operate on the homogeneous market. Other assumptions are that there is not transaction costs and all the traders or investors know all the information that are available in the market regarding risk-free rate and risk premium of the portfolio of securities (Yunus, 2013).

1.2 Merits and Demerits of the CAPM model

There are several merits of the capital asset pricing model of Financial Management Help. The most important merit is that the expected return on a particular portfolio of securities can be ascertained easily. This is due to the fact that this model takes the market risk that is the beta under consideration (Yunus, 2013).Adding to this, the investors can easily calculate the market premium and risk-free rate of the portfolio of securities.

ORDER This Financial Management Assignment NOW And Get Instant Discount

Bornholt (2012) opines that there are various disadvantages of the capital asset pricing model. One of the pivotal disadvantages is that this model considers that all the shareholders and investors have several data with them and the security market is homogenous. Moreover, it also assumes that expected return variances of a portfolio can be easily calculated. However, in the current market scenario, all these assumptions are very much unrealistic in Financial Management Help.

1.3 Application of Security Market Line and Capital Market Line

The capital asset pricing model helps to interpret the security market line and capital market line of a portfolio of securities.

The Security market line is a continuation of the CAPM model. This line reflects the correlation between the beta of the stock and the expected return of the stock. The overall slope of the security market line is the risk premium, whereas the intercept of the line is the portfolio’s risk free rate (Web.stanford.edu, 2015).

Fig 1: Security Market Line (SML)

(Source: Barrow, 2011, pp. 256)

The above diagram reflects the relationship between return and beta of the stock. The equation of the line is SML= RF + (Rm – RF) * Beta.

On the other hand, the capital market line reflects the highly leverage assets from a portfolio of the assets.

The equation of the capital market line CML = risk free rate + Risk premium-Risk Free rate / Sigma.

These are the applications of security market line and capital market line.

1.4 Extent and Application of CAPM model

The application of the capital asset pricing model can be done with the help of several elements. At first, the beta of a particular stock will be calculated with the help of variances and returns of the stock in the last four years.

| Calculation of Beta | ||||||

| Years | Returns(Actual return) | Market premium | Ra-Ra | Rm-Rm | ||

| 1 | 16.2336 | 3 | -1.40105 | 2.25 | 1.751313 | |

| 2 | 16 | 12 | -1.63465 | 1..25 | 0.408662 | |

| 3 | 25.65 | 7 | 8.01535 | 0.25 | 6.011513 | |

| 4 | 12.655 | 6 | -4.97965 | 0.55 | -3.73474 | |

| 70.5386 | 29 | 4.43675 | ||||

| 17.63465 | 7.25 | |||||

| Beta | 1.478917 |

Table 1: Calculation of Beta for a stock (Assumed)

(Source: Created By Author)

In this example, the beta of the portfolio can be calculated as 1.48, whereas the risk free rate is assumed as 9 percent and the market risk premium is assumed as 13 percent, therefore, the expected return on that particular stock can be calculated as the following:-

Expected return = 9+ (13-9)*1.48 = 14.92. The expected rate of return is calculated as 14.92, whereas the average return of the stock is 17.63. Therefore, it can be deduced that the particular stock has over-performed in the current market scenario. This is the overall application of the capital asset pricing model that is performed by the investors.

1.5 Alternative model: Arbitration Pricing Theory Model

This theory of Arbitration pricing model assumes that the return that is expected from a portfolio of assets can be obtained by a linear function as well. This theory can be preferred over the CAPM model as this theory is based on realistic assumptions on the elements of micro-environment (Bornholt, 2012). It does not require any risk premium, but is based on the overall pricing of the risky portfolio assets.

ORDER This Financial Management Assignment NOW And Get Instant Discount

1.6 Recommendations

The investors and shareholders of the business organization need to acquire all sorts of information before implementing their portfolio based on the capital asset pricing model. The information must be related to the risk free rate of the market and market premium of the portfolio of securities. If all the information is not available, then they can use the arbitration pricing model.

1.7 CAPM model: Summary

From the above analysis, it can be inferred that Capital Asset Pricing Model is very useful for calculating the expected return of the portfolio after calculating the market risk and market premium. Further, this model is very useful for a longer period of time than a short span of time. Therefore, the investors need to use this model very wisely.

Part B: Analysis of Capital Budgeting

2.1 Calculation of NPV

The Net present value of the machinery can be calculated with the help of cash inflows and cash outflows (Barrow, 2011).

The depreciation of the new machinery = 280000- 40000/5 (Salvage value= 40000)

= 48000.

The total chargeable tax can be calculated as 30% of 86000 = 25800. Therefore the calculation of the net present value of the machinery can be calculated with the help of the following table:-

| Initial investment | -280000 | Cost of capital | 9% |

| Year | Initial cash inflows | NPV @ 10% | |

| Year 1 | 72200 | 0.902 | 65124.4 |

| Year 2 | 22000 | 0.826 | 18172 |

| Year 3 | 22000 | 0.751 | 16522 |

| Year 4 | 22000 | 0.683 | 15026 |

| Year 5 | 27000 | 0.621 | 16767 |

| Net Present Value | -156,566.63 |

Table 2: Calculation of NPV

(Source: Created By Author)

2.2 Decision process

Henry should not purchase the new machinery as the net present value is coming as – 156566.63. Therefore, he will incur losses if he purchases the new machinery

Conclusion

The Financial Management Help highlights the importance of CAPM and the alternatives of the CAPM model. It also highlights the role of NPV for selecting new machinery. Both these techniques can be ignored for the purpose of financial management in an organization.