Topic for Economic Assignment: Evaluation Of Macroeconomic Performance of Australia and US

Introduction

Microeconomic performance is the analysis of a country’s economic performance according to the Economic Assignment. It is a measurement of the results of a country’s economic policy when compared to the key objectives in the government policy. The main objective of the measurement of microeconomic performance is to study the gross domestic growth rate (GDP), and other key economic indicators and its effect on the standard of living of the population (Gordon, 2010). However, the primary objectives of microeconomic policy are not only concerned with standard of living or the lifestyle of its population but it also considers the following factors like the rate of employment, Inflation rate, trading performance, efficiency of the economy in managing its resources and ability and the effectiveness of its economic policies in providing proper educational and health services to the citizens of the country.

a) Relation between GDP growth Rate and the other indicators between two countries

A country’s Economic Assignment growth and health is measured with the help of gross domestic product or GDP. The gross domestic product is the total market value of all goods and services produced in a country in a particular year. It is used to measure a country’s standard of living. A good GDP growth ensures that rate of inflation decreases. Employment levels increase but 2 % for every one % increase in GDP. Since there is the continuous rate of increase of GDP in both UK and Australia it can be assumed that employment levels are quite low in both these countries. The CPI is the country’s indicator of inflation, unemployment and the standard of living in a country. Therefore both GDP a bad CPI are closely related. A higher exchange rate affects the exports of a country negatively. Due to which exchange rate plays a very important factor and are paid attention by investors and concerned authorities, and a lower exchange rate makes it exports cheaper and more profitable, and its imports more expensive. Hence rate of GDP affects the exchange rate positively or negatively of Economic Assignment.

Tables and graphs of real GDP growth rates,

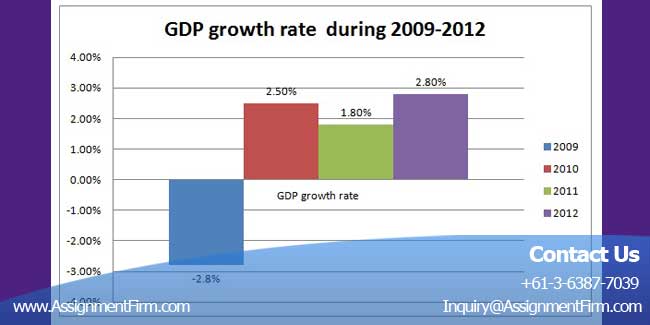

Following is the GDP growth rate of USA.

Figure 2: GDP growth rate in US (2009-2012)

(Source: data.worldbank.org, 2014)

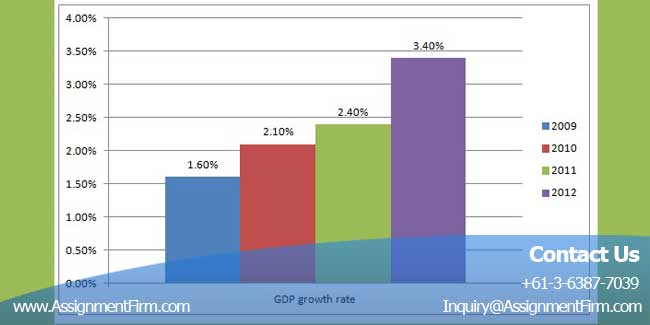

Figure 3: GDP growth rate in Australia (2009-2012)

(Source: data.worldbank.org, 2014)

Inflation Rate of USA – the Inflation rate in USA was at 2 % in April 2014. Inflation rate in the United States aggregated 3.33% from 1914 to 2014, peaking to 23.70 % in June 1920 and a it was at its lowest in June 1921.The Inflation Rate is reported by the US Bureau of Labor Statistics.

Unemployment Rate- The unemployment rate in the United States stands at 6.3% in the year 2013. The unemployment rate remains at an aggregate of 5.83 % from 1984 until 2013. The unemployment was at its peak in the year 1984 which was 10.8 % and the lowest recorded unemployment peak was 2.5per cent in May 1953.

Exchange rates interest rates according to Economic Assignment- The exchange rate is one of the most important factors affecting the economic condition of a country. An exchange rate is a value at which one currency will be exchanged for another. Every country through many mechanisms controls the value of its exchange rate these mechanisms help in determining the exchange rate regime that will apply to its currency. A higher exchange rate affects the exports of a country negatively. Due to which exchange rate plays a very important factor and are paid attention by investors and concerned authorities, and a lower exchange rate makes it exports cheaper and more profitable, and its imports more expensive Economic Assignment. A higher exchange rate negatively affects a country’s balance of trade negatively while a lower exchange rate makes it more positive and effective. (Refer to Appendix 4)

ORDER Economic Assignment And Get Instant Discount

The gross domestic product is the total market value of all goods and services produced in a country in a particular year. It is used to measure a country’s standard of living. The gross domestic product (GDP) of US is 15.68 trillion USD (Gordon, 2010). The United States is one of the most different and technologically improved economics assignment help in the world. Important activities like Finance assignment help, insurance, real estate, rental, leasing, health care, social assistance, professional, business and educational services are factors which promote GDP growth and occupy 40 % of GDP.

b) The correlation between interest rate and inflation and interest rate and unemployment?

Inflation rate refers to the rate at which the prices of goods and services are related and are always used in microeconomics. In the United States, Federal Reserve sets the interest rate. Inflation rate in USA was at 2 % in April 2014. Inflation rate in the United States aggregated 3.33% from 1914 to 2014, peaking to 23.70 % in June 1920 and a it was at its lowest in June 1921.The Inflation Rate is reported by the US U.S. Bureau of Labor Statistics. The consumer Price index (CPI)is the approved measure of inflation of consumer prices. It is also known as Harmonized Index of Consumer Prices (HICP). The CPI finds out the average price increase as a %age for a basket of 700 distinctive goods and services. If inflation rates are lowered more people borrow loans in order to fulfil their wants and desires. As result prices of goods increase, thereby resulting in growth of inflation. So we can see that inflation increase as a result of decrease in interest rates. So it is the job of the concerned authorities, to check the rate of interest. It acts as the most vital factor affecting inflation, and thereby the Economic Assignment growth of the country. Interest Rate and unemployment are closely related. Interest rate as interest decrease more people are able to borrow loans, Thereby resulting in the prices of goods increase. This negatively affects the economy of a nation as the gdp growth rate decreases or remains stagnant. Investors feel hesitant to invest in a country with decreasing gross domestic rate. This leads affecting the economic activities of a nation. This creates a negative effect on the employment rate of a country.

Retail and wholesale Economic Assignment occupy about 12 % of GDP. Utilities, transportation, warehousing and information constitute for 10% of GDP. Manufacturing, mining and construction account for 17 % of the output (Bell and Young, 2010). Agriculture constitutes for 1.5 % of the GDP, however, the country using modern technologies it is not an exporter of food (Gordon, 2010). In the working population, the jobless rates for adult men are 5.9%, adult women are 5.7 % Teenagers is 19.2 % whites are 5.4%, blacks are 11.5%, and Hispanics is 7.7 %.

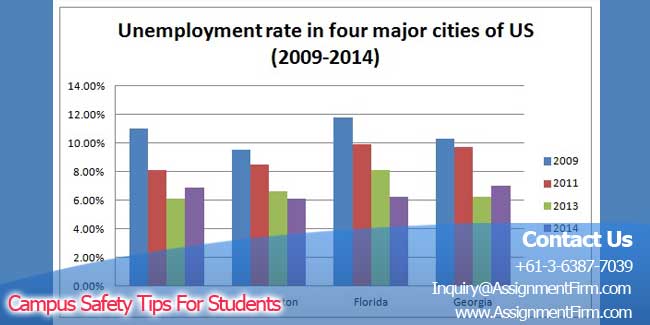

The unemployment rate in the United States stands at 6.3% in the year 2013. The unemployment rate remains at an aggregate of 5.83 % from 1984 until 2013. The unemployment was at its peak in the year 1984 which was 10.8 % and the lowest recorded unemployment peak was 2.5per cent in May 1953.

Figure 1: Unemployment rate in four major cities of US (2009-2014)

(Source: www.ncsl.org, 2014)

The consumer Price index (CPI) is the approved measure of inflation of consumer prices. It is also known as Harmonized Index of Consumer Prices (HICP). The CPI finds out the average price increase as a %age for a basket of 700 distinctive goods and services. Information on the he prices of each product are observed form 120,000 various outlets. The consumer Price index (CPI) in the United States increased from 236.25 Index points in April 2013 to 235.36Index in March 2013.Consumer price index in the United States in the year 1950 was 102.24 and it was highest in March 2013 at 236.64.

The United States is the top exporter of Delivery trucks, Gas turbines, Delivery Trucks, Gas Turbines, Human or Animal Blood, Medical Instruments, Aircraft Parts, Excavation Machinery, Scrap Iron, Combustion Engines, Wheat, and Soybeans. Canada (16%), Mexico (13%) China (7.9%) Japan (5.15) and Germany (4.6%) are the top 5 export destinations of the United States. The recognized US Import and export statistics of Economic Assignment reveal government and non- government among foreign countries and the US customs territory. Top products that are imported include Crude Petroleum (15%), Cars (6.1%), Computers (4.1%), refined Petroleum (4.1%) and vehicle parts (2.5%) and the top import destinations china, Canada, Mexico, Japan and Germany. The interest rate in the United States is 6. 05% %. Interest Rate in the United States was it at its peak at 20 % in March 1980 and it was lowest in December 2008. This rate is given by the Federal Reserve. The board of Governors is the authority on the changes in the discount rates based on Economic Assignment of the recommendations submitted by Federal Reserve Bank.

An exchange rate is a value at which one currency will be exchanged for another. The everey country through many mechanisms controls the Economic Assignment value of its exchange rate These mechanisms help in determining the exchange rate regime that will apply to its currency. The exchange rate determines the purchasing power of a particular currency when compared to another currency. Australia has one of the largest economies in the world with a GDP of US $ 1.5 trillion as per 2013. The GDP value of Australia constitutes 2.45 % of the world economy.GDP i Australia was as 325.67 USD Billion from 1960.The world Bank gives the report about the value of GDP of Australia.

In Australia, the unemployment rate is measured by the number of people actually looking for job as a %age of the labor force. The unemployment rate in Australia stands at 5.8 % in 2013. The consumer price index is 104.80 in 2013. This was recorded lowest at 4.20 Index points in March 1950. In Australia Consumer price index (CPI) is the measurement of changes in the prices paid by the common public for goods and services. Major Australian exports include Iron ore, Coal, Gold, Natural gas and crude petroleum. Major Australian exports include China, Japan, Republic of Korea, India and the United states.

c) Reasons why the macroeconomic indicators in both countries correlated

Microeconomic indicators of both USA and Australia are correlated. It can be seen that there is a similar pattern in both these countries, GDP growth rate is growing at a steady pace therefore the inflation levels and employment levels are stagnant. Corporate investment is very high in these two countries which ensure high employment level and good quality lifestyle. The exchange rate of both USA and Assignment Help Australia is kept at a moderate level which leads to profitable exports and imports of both countries. Therefore it can be seen that that macroeconomic indicators in both countries is correalated.

ORDER Economic Assignment And Get Instant Discount

d) Monitory policies in both countries:

The Australian monetary system requires no accountability to preserve minimum reserve for its banks. The reserve bank tries to maintain an inflation rate of 2-3 % throughout the year, and for this they take measures to implement them. This target is done to compare bank and the government. The cash rate is the interest rate on plans made among institutions in the money market. The reserve bank acts to implement measures to achieve this cash rate. This cash rate is decided on the basis of measures taken as a result of effect of demand and supply of overnight funds. No regulatory requirement for banks is there in Australia to have exchange settlement fund. In the United States the Federal Reserve is in charge of monetary policy, and establishes them by performing activities that has an effect on the short term interest rates. The federal bad has implemented certain measures in monetary policy for money creation. In US, Bank are required to go their transaction daily. Certain proportions are money is kept and a minimum portion is given as loan to the common public. Treasury bonds are issued to raise additional money. Banks sell treasury bonds and the government benefits from it. Banks sometimes purchases these securities, so these treasury bonds play a important role in these process. The Federal Reserve in US contributes to open market operations. If they want to increase the supply of money , it will buy securities ( like US Treasury Bonds) from the banks and this benefit the money supply by the inflow of dollars, if the federal reserve’s want to decrease the money supply they will sell the securities ( like treasury bonds ) to decrease the inflow of dollars, thereby decreasing the money supply. So by means of open market operations the free reserves of commercial banks, this is how the Federal Reserve creates the monetary policy, and an average amount of money is transformed into large amount of money, so establishing the success. Therefore monetary policies in the US are tighter. (Refer to Appendix 2 )

e) Microeconomic outlook of USA and Australia

Australia- Microcosmic policies were introduced to increase the standard of living in Australia. Many policies were introduced with the objective of economic growth and prosperity had a negative consequence on the Gross domestic product (GDP), thereby slowing economic progress of the nation. Policies concerning industry protection government business enterprises and industrial relations made negative consequences on industries with huge prospects of growth. A weak meant that they were unable to deal with the pressures of advancing technology, global competition in Small-scale production facilities and weak technologies, and inefficient management and business activities. Poorly planned investment activities led to decrease in employment opportunities and hindered the growth of the nation. Microeconomic activities ere were established to solve a n number of these opportunities taking proper steps to improve Australia’s economic performance. Important policies became an essential priority from 1990s. The Australian monetary system requires no accountability to preserve minimum reserve for its banks. The reserve bank tries to maintain an inflation rate of 2-3 % throughout the year, and for this they take measures to implement them. This target is done to compare bank and the government. The cash rate is the interest rate on plans made among institutions in the money market. The reserve bank acts to implement measures to achieve this cash rate. This cash rate is decided on the basis of measures taken as a result of effect of demand and supply of overnight funds. No regulatory requirement for banks is there in Australia to have exchange settlement fund.

USA- Every four to six years, the economy of the US leads to stagnation. Us economy in 2o13 is in a decreasing pace. Unemployment is high, and investment activities have slowed down. So to reform these they have taken number of banking measures to rectify this situation. In the US, Bank are required to go their transaction daily. Certain proportions are money is kept and a minimum portion is given as loan to the common public. Treasury bonds are issued to raise additional money. Banks sell treasury bonds and the government benefits from it. Banks sometimes purchases these securities, so these treasury bonds play an important role in these process. (Refer to Appendix 3)

ORDER Economic Assignment And Get Instant Discount

Conclusion:

Both Australia and US have made great improvement in the field of macroeconomic policies and reforms, that have reflected in great economic benefits. It is their job to uphold the good work. The gross domestic product is the total market value of all goods and services produced in a country in a particular year. The main objective of the measurement of Economic Assignment performance is to study the gross domestic growth rate (GDP) and other key economic indicators and its effect on the standard of living of the population. However, the primary objectives of microeconomic policy are not only concerned with standard of living or the lifestyle of its population but it also considers the following factors like the rate of employment, Inflation rate, trading performance, efficiency of the economy in managing its resources and ability and the effectiveness of its economic policies in providing proper educational and health services to the citizens of the country.