Economics Assignment Help Question 1:

Significance of the observations made in case of “All risky political business left for after the election” about the fiscal policy:

Fiscal policy takes an important role to the politicians, as government adjusts its spending levels and tax rates to monitor and influence the Economics Assignment Help and economy of a nation. This policy is used with various ways to address a country’s economic goal. The implementation of it may affect different people in economy. The fiscal policy can take a lead role in underdeveloped countries. In a domestic society the direct method are not approved, so the government wishes to depend on indirect method of regulations. As a result it is powerful weapon to government to achieve the way of developments (http://www.business.uwa.edu.au, 2014).

However the author point out that all risky political business left for after the election. It is surely point out that huge type of expenses is needed for the election. So government wishes to recover that after the elections. According to the Australian government in 2001, they estimate the economic growth would be $1.5 billion (Colander, 2000). But the Australian Democrats leader argues the government wish to expense $2.9 for improvement expense. So it is a different type of problem. A running government wants to re-elect again. As a result they wish to provide some taxation rebate. According to author this rebate will help to stop the Australian economic growth. The democrats’ leader also argued that the Australia government wants to cut $5 billion business tax and to extent $1 billion of natural heritage. Australia is trying to develop itself, but this kind of rebate will affected to the future Australia. While a country is in its development phase, then the rebate of taxation is not tolerable. So it is point out that this taxation rebate could addressed as “Campaign Budget.”

Actually this kind of budget helps to provide the people a few days relaxation. But after some day whenever the economic structure of the country is fallen in a difficult situation, then the common people faced the difficulties. If this kind of rebate would not provide, the economic structure of a country rise up day by day (Colander et al. 2008). Common people are suitable to pay their current taxation report. But when the economic structure of the country will break down, then the common people will asking some additional tax where they are already in an economic crisis. Another point appears here, this budget is not clear to the small businessman. Actually the government announced the various kind of package for old people, pensioners and self-funded retirees. But it did not announce anything for the small businessman. Although small business is the key factor to grow up a country, but the government avoid them. In this article the government announced to rebate huge amount (Temple, 2002). So the next development will fall in adversity, such as employment and the development of social structure. Small businessmen are not clear about their taxation, so they will affect with this budget. They are belongs in a middle class family, so total middle class will fall in a wide trouble. Basically this taxation rebate will help to the upper class. So in a critical situation the middle class may have to pay more taxes than the wealthier upper class. As a result the author argued that before the election the political leader are provide some benefit, which became a risky factor after the election.

ORDER The Australian Financial Review Case Study And Get Instant Economics Assignment Help Discount

Economics Assignment Help Question 2:

Definition and roles of discretionary fiscal policy in annual budget:

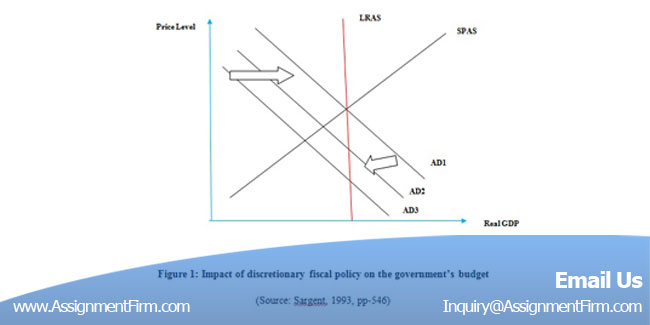

Unnecessary changes in the tax structure, government spending and other fiscal activities by the government in response to the changes in the economic condition. In other word, discretionary fiscal policy refers extra government intervention in the economic changes above the existing fiscal policies. Discretionary fiscal policy often occurs in the period of recession or other economic downturn (Galor and Zeira, 1993). Discretionary changes imply changes in the expenditure levels and deliberate changes in the revenue pattern by the government. Discretionary fiscal policy is an action that is mainly taken by the Federal Government and in this policy changes are taken place year to year. This policy basically executed by the change in the tax code. In the annual budget, the portion of discretionary fiscal policy is lies outside of the mandatory spending such as Obamacare, Medicaid, Security etc. Discretionary changes in the government budget mainly alter the structural component of the budget in order to provide stability into the economy in medium term.

Figure 1: Impact of discretionary fiscal policy on the government’s budget

(Source: Sargent, 1993, pp-546)

As illustrated by Castellani and Zanfei (2002), discretionary fiscal policy is often used to enlarge the economy’s activities and to contract it. Expansionary fiscal policy implies decrease in the tax level and increase in the government spending. This policy usually enlarges economic growth, reduce rate of unemployment and create more profitable business environment. If this successful in ensuring all the activities simultaneously, economy grows at fastest rate. Discretionary fiscal policy also strengthens government deficits as through discretionary fiscal policy government spending more. As the government spending exceeds the tax rate that the government collected government deficits increases. This process is going on until debt to GDP ratio reach to the 100% level. In this point the government comes to know that the government is not repaying its sovereign debt and thus they are not willing to buy the government bond and to finance the debt.

On the other hand, Guimónm (2009) depicted that, contractionary fiscal policy act on the opposite sites. When the government body implements contractionary fiscal policy, economic activities slow down and less money goes to the taxpayer pocket. Various political processes suggested that discretionary fiscal policy is always explain expansionary policy as the law maker in the economic activities are always elected by spending lots of money. Elected special interest group and reward their voter who positively denote for the campaign. Everyone prefers to have budget cut for the entire economy, not just for their own portion of budget.

Thus, discretionary fiscal policy is sometime act as the counterweight in the economic business cycle. At boom period, President and the Congress always focus on reducing their spending in order to keep cool the economy. In order to done all economic changes effectively, the reward strategy will be more efficient for bringing ideal rate of economic growth. In most of the cases it is shown that the rate reaches to the 2 % to 3 % in a year (http://www.cbi.org.uk, 2014). By spending more government stimulate economic activities and create more assets bubbles for ensuring more devastating bust.

ORDER The Australian Financial Review Case Study And Get Instant Economics Assignment Help Discount

Impact on the annual budget:

One of the most important examples of discretionary fiscal policy is annual budget of the economy. Discretionary fiscal policy involves common wealth of changing expenditure and revenue pattern of the economy in order to achieve range of objectives. Through discretionary fiscal policy, government can estimate total expenditure and revenue for the coming next few years. Expenditure and revenue pattern for the coming few years are the main instrument of government’s fiscal policy (Ziegart and Andrea, 2000). Discretionary fiscal policy reflects the structure of change in revenue and expenditure pattern which are the basic components of annual budget. Discretionary fiscal policy is also effective for estimating the level of economic growth, inflation rate, interest rate, unemployment condition in the economy and external stability. Discretionary fiscal policy is effective to reduce budget surplus by slow down an overheated economy and by reducing interest and inflation rate. At the same time budget deficits is often used for recovering an economy from recession situation (Sargent, 1993). On the other hand, change in the process off revenue collection, wealth distributional pattern and effective allocation of the resources also affected by the discretionary fiscal policy. Thus, the major objectives of federal government in an country is to achieve fiscal balance throughout the whole business cycle.

How the discretionary fiscal policy differ from the automatic stabilizer:

Discretionary monetary policy is economic policies those are based on judgment of the policy maker in the situation that the policy maker set rules against some predetermine rules. Example of the discretionary fiscal policy may be passing a new spending bill due to some causes (Sanna-Randaccio and Veugelers, 2007). On the other hand, when an economy goes through the some economic fluctuation, automatic stabilizer immediately takes some steps without any interference from the government bodies. In case of discretionary fiscal policy there is a significance time lag before taking any actions. Automatic stabilizer is limited on managing aggregate demand in the economy and on the other hand, discretionary fiscal policy is basically target within a limited region in a country. Automatic stabilizer exists in both the situations, namely boom and bust. But discretionary policy is response with the changes in the economy. Thus, discretionary fiscal policy is response to the changes in to the economy and do not bound to follow a strict rules and regulations to manage a situation in a systematic manner. On the other hand, automatic stabilizer policy automatically changes the fluctuations in the country’s GDP.

Economics Assignment Help Question 3:

Summarization of the expenditure and tax changes:

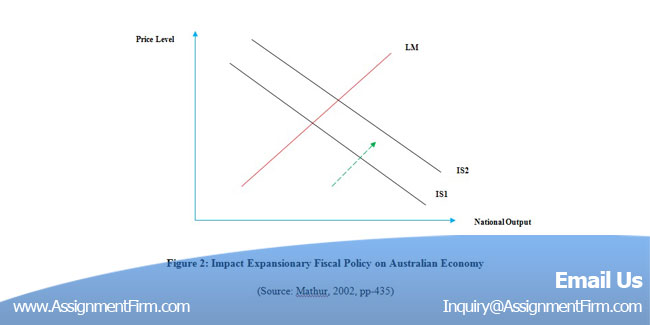

Among few economy, Australia is one of the few economy which is not much influenced by the global economic crisis as economic stability in the Australian economy is ensured by International Monetary Fund (IMF). There are some other reason those are strongly contributes towards maintaining economic stability for example, flexible exchange rate regime, strong demand for its natural resources and active fiscal policy taken by the Australian federal government (Obstfeld and Rogoff, 2001). On the third term of the campaign, The Australian economy goes down the economic surplus to $ 1.5 billion and economic growth reach to the 3.25 % in a year. Government has supported the older people in the economy by introducing tax break of about $ 1.3 billion. At the same time, government in this economy introduced strong investment on the public health and education. Thus, there was a huge changes has taken place in the welfare of the economy. In the annual budget of 2003-2004, the government plan to minimize the political risk by investing $45 billion on the privatization of Telstra Crop.

Figure 2: Impact Expansionary Fiscal Policy on Australian Economy

(Source: Mathur, 2002, pp-435)

In the year 2001- 2002, the forecast GDP growth in the Australian economy was 3.25 %. In the global market, Australian economy established a competitive position by introducing competitive cost structure wih Economics Assignment Help. As the economy is effectively maintain a stable rate of inflation in the economy, they have strongly maintain good position in debt on their budget and due to low interest rate regime, they have gained huge growth in the exporting sector (Cincera and Tübke, 2009). The business sector observed strong turnover in the business investment and this is mainly due to lower oil and soft landing price in the US economy. Despite the all these improvement, the financial sector in the Australian economy were slightly insensitive. Bond and dollar market are quite responsible for that. Small firms are doing nothing to add the improved condition of the budget with their family members. Economic instability condition pushed the Australian economy into the international economic downturn. In the year 2011, government has made $27 billion additional spending on the defense service and at the same time $5 billion business tax was cut. This provides additional scope to the Australian economy to spend in the economy during the election. But the economy is failed in delivering scope for innovation m in the concern of business.

ORDER The Australian Financial Review Case Study And Get Instant Economics Assignment Help Discount

The Australian Economics Assignment Help and economy has successfully avoided the recession by ensuring stimulus economic program and expansionary fiscal policy. In this period, the economic flexibility is much higher as compared previous economic situation. In this period the Australian economy is strongly rely on the expansionary fiscal policy (Mathur, 2002). As per the data revealed by the Australian Treasury, the financial growth rate of the economy in the year 2003 was 2.1 %. But there was no significant changes taken place in case of revenue earned. The Economics Assignment Help with economy faces about $500 million losses in total revenue. Unemployment rate was the one of the big problem in the Australian economy. in the year 2002, the rate on unemployment rose to the 7% upward. As the economy going through the boomed period, in the year 2000, unemployment rate fall to the very low level, in 2002, the rate goes up and for the year 2006, again the unemployment rate fallen to the 5.1%. From the growing employment rate it can be infer that there was a significant growth in the aggregate demands. Even though, the demand structure, export level, economic growth was affected by the downturn in the US economy in the year 2007-2008.