Instructions to students: This is an individual assignment.

Maximum marks: 20 (20%)

Maximum word limit – 1500 words.

Task: HI6028 Taxation Theory, Practice And Law Assignment

Question 1 (15 marks)

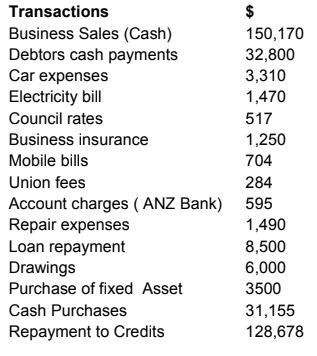

Daniel and Olivia Smith operate a mixed business called Brekkie and Lunch and OZ Bottle Shop at 50 York Street Sydney. They visit you in order to prepare their 2017 partnership tax return. During your first meeting they provide you with their cash receipts and cash payments journals, their business bank statements and a file contain all their business invoices and receipts relating to the transactions in their book. Details of the transactions are as follows:

After careful consideration of the working papers from last year’s return, you establish:

i.

Debtors at 1st July 2016 3,925

Debtors at 30th June 2017 3,010

Creditors at 1st July 2016 6,500

Creditors at 30th June 2017 7,010

Stock on hand 1st July 2016 9,120

Stock on hand 30th June 2017 9,750

ii. Some of the creditors were paid directly from the cash receipts account. Overall, $31,155 of stock was purchased in this method. Additionally, $5,600 in cash has been used for private purposes.

iii. The owners have taken $3,200 from Bottle Shop items for private use.

Question 2: HI6028 Taxation Theory, Practice And Law Assignment T3 2018-Holmes Institute Australia

John is a senior executive with a printing company. As part of his remuneration

package his employer pays for his child’s school fees at a private school costing

$15,000. His employer also provides him with accommodation in a Sydney

apartment throughout the FBT year. John must pay $100 of rent per week for the

apartment. The market value rent for the apartment is $800 per week.

Advise John’s employer of the FBT consequences of John’s remuneration package.(5 marks)

ORDER This HI6028 Taxation Theory Practice And Law Assignment NOW And Get Instant Discount

Get BBAL501 TAXATION LAW Assignment written by expert.