Instruction to students: This is not an individual piece of work.

Total Marks available: 40

Weight: 20%

Task: BBAL501 TAXATION LAW Assignment

Students (groups of 2 to 3) are to jointly research and present a case law decision related to a tax topic or part of a tax topic. The presentations should summarise the issues and decisions relevant to the case. A good presentation will include a good analysis of student thoughts on these decisions (with reasons).

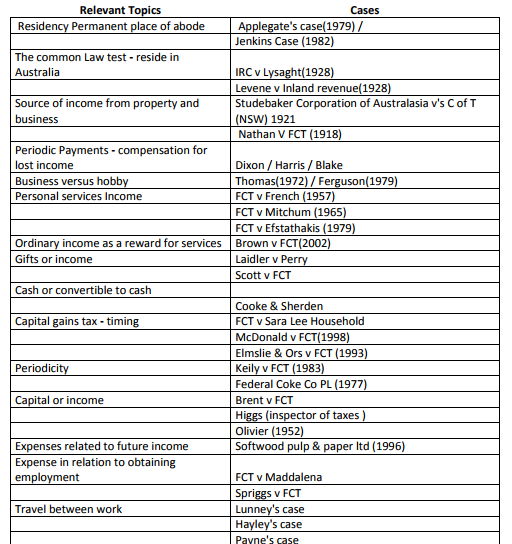

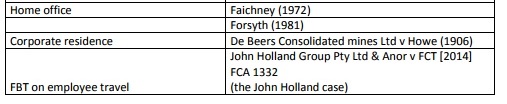

Students will be provided with a list of cases relevant to a particular topic from which to choose (refer to attached list).

No individual presentations are allowed.

Presentations should be 10min (max) in duration and all students must participate in the presentation. (No presentation – no marks)

Presentation slides: Please ensure that the first slide of your presentation

includes the following information

Students must ALSO prepare a report (Maximum 2 pages, 800 words) .

ORDER This BBAL501 TAXATION LAW Assignment NOW And Get Instant Discount

How will your presentation be marked?

This task has two parts:

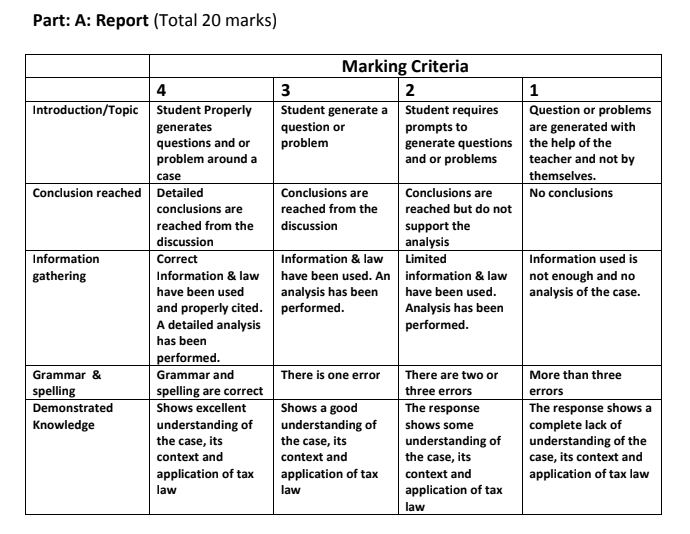

Part A: Written Report (20 marks)

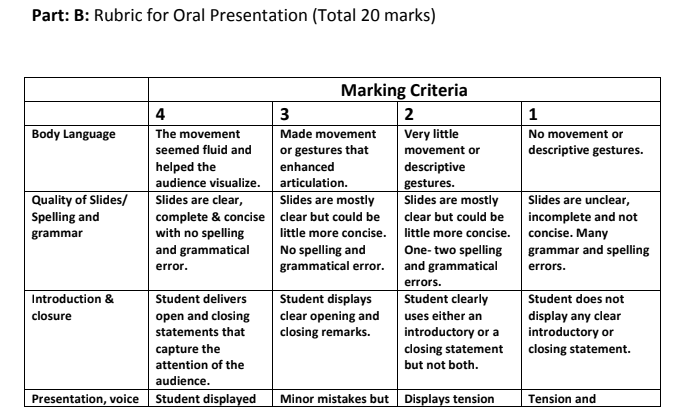

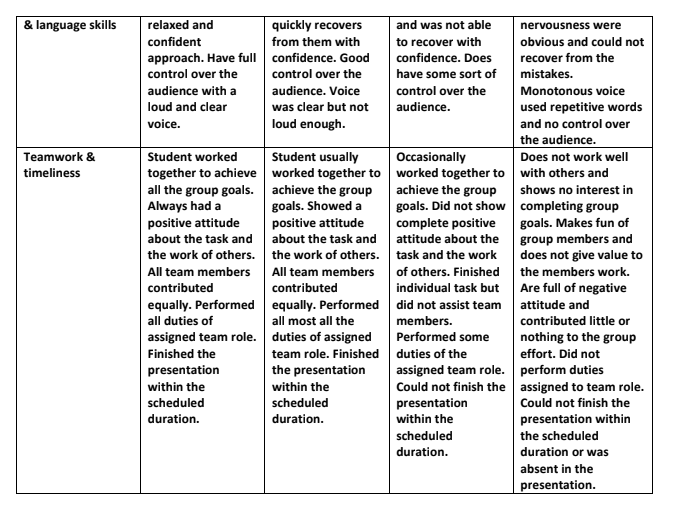

Part B: Oral Presentation (20 marks)

Weight: 20%

Marking Rubric: BBAL501 TAXATION LAW Assignment-Cambridge International College Melbourne Australia

Marking rubrics have been prepared to explain the marking criteria’s applicable for both the written report and presentation. Marks will be awarded following the marking criteria only.

ORDER This BBAL501 TAXATION LAW Assignment NOW And Get Instant Discount

List of Cases:

ORDER This BBAL501 TAXATION LAW Assignment NOW And Get Instant Discount

Get LEGL300 TAXATION LAW Assignment written by experts.

Get HI6028 Taxation Theory, Practice And Law Assignment written by experts.