Introduction

The Business Accounting is stated to the process of measuring and communicating with the financial information evaluated to make critical and strategic decision making in the prospect of the organizational management. It was stated to be the language of business that provides an overall idea of business performance based on financial, operational and functional activities (Stickney and Weil, 2009). In the particulate study, the west group Accountants and Investment Advisers will make a critical investigation on different issues, business reports and financial evaluation with ratio analysis of Harvey Norman Holding Limited in relation to provide proper recommendation in making an investment in the company as per its Business Accounting and present financial scenario and positioning in the marketplace.

a) Core Business Activity: Harvey Norman Holding Limited

The Harvey Norman or Harvey Norman Holding Limited is an Australian Retail company that provides product related to electrical appliances, computer products, furniture related products entertainment and bedding products. It has been stated as one of the major brand and franchise operating in the Australian Market (HarveynormanHolding.com.au, 2014)

In the international marketplace, the company’s Business Accounting has been established it’s branding over 230 stores in the countries like New Zeeland, Slovenia, Ireland, Malaysia, and Singapore. As per the evaluation, it has been stated that the online stores been launched by the company is operated by the independent franchisees It has been stated that the current year of 2013, the company has provided more technological impact in relation to make easier for the customers for comparing it’s Business Accounting by chose and buy products from the online stores of Harvey Norman (HarveynormanHolding.com.au, 2014).

As per the global reviews the company’s Business Accounting has been estimated as one of the best online retail shops as per the customer experiences in the year of 2013. As per the Business Accounting and financial performances, the stock price of the company has been increasing with the price rate of $ 3590 that has been increased in comparison to previous year that is been estimated $ 3560 (Harveynormanholdings.com.au, 2014).

Figure 1: Business Accounting Reports

(Source: Chapman, 2012, pp- 62)

b) Significant Issues discussed in Chairmen’s Report

As per the chairmen report of the company, it has been evaluated that the retail market in Australia is more competitive in the year of 2013 (HarveynormanHolding.com.au, 2014). It has been stated that the company has estimated more appropriate and significant growth and development in the marketplace. As per the evaluation of the Business Accounting report, it has been stated that the marketplace. It has been stated that the company is facing a tough competition in the marketplace (Frankel et al. 2010). In relation to the net profit of the company it has been certainly reduced to 39.1% in the year of 2012 that can be reviewed to 5.2% of reduction on the reassessment of the properties. The report evaluates that the company properties valuation has been declined in the year of 2013 by 2.1% that might issue for the company as it certain declined the business operations to a certain pain (HarveynormanHolding.com.au, 2014).

However, in the year of 2013 some of the issues being faced by the company related to the customer segmentation as per the brand recognition as there is a tough competition in the their retail market. The report evaluates that the company is been engaging Omni strategies in relation to providing brand and customer issues related to the positioning of the company in the market (Dandago, 2009).

c) Significant Issues discussed in Directors Business Accounting Report

The Harvey Norman Limited director’s reports stated that there are almost 11 full board members in the organizations in every meeting to make critical discussions on the business growth development and issues faced by the organizations as per the present business scenario (HarveynormanHolding.com.au, 2014). It has been stated that the Board members of the company monitors and measures the environmental obligations that might become issues for making a prominent growth and development of the company in the international marketplace. It has relevant policies of complying with different problems being faced by the company (Berman, 2008). As per the report, there are few issues that been effected in the year of 2013, inspire every operational, financial, business affairs seem to be proper and developing situations. The director’s report of the company provides some of the issues such as fluctuations in the microeconomic conditions that might increase risk of customer satisfaction failures, competitions in the market might decline the pricing of shares and most relevantly increase in the network and distributional channel of the competitors might decline the market share enjoyed by the company (Soleimani and Salehfar, 2012). However, the Business Accounting report suggests several business strategies that increase the future business and financial development of the company. OFR or office of financial research evaluates that the company is increasing its financial positioning with an assessment of every risk to enhance shareholders support and satisfaction in the company (HarveynormanHolding.com.au, 2014).

d) Corporate Governance Report: Harvey Norman Holding Limited

The corporate governance practices are been established through out the financial year of the company in relation to enhancing the business internal and sectional activities along with proper control and measurements (Chenhall, 2012). As per the management, the corporate governance provide a proper set of rules and policies within the shareholders, management and board of directors of the company in relation to decrease risk impacts, increase in public image, enhancement of the business activities with support and contribution of shareholders and stakeholders of the company (Woelfel, 2009). The corporate governance statement of Harvey Norman Limited estimates that the major goal of forming corporate governance is to the identification of stakeholders and shareholders expectations. It is one of the major aims of the corporate governance form is to seek the major business risks been impacting the company (HarveynormanHolding.com.au, 2014).

As per the corporate governances, it stated that the strategic plans need to be analyzed, ongoing planning needs to be monitored and measured, preparation and implementation of budgeting are necessary to evaluate future business performance and financial resource needs of the company (DeWet, 2009). The corporate governance report of the company evaluate the implications of different committee in the company such as Nominating employees, auditing financials, Auditing analysis, This strategic committee form in relation to engage specific risk management that is been elaborated analysed and measured by board of directors to increase the performance of company in the marketplace (HarveynormanHolding.com.au, 2014).

e) Key financial ratio analysis

Liquidity Ratio (In the year 2013)

Current ratio= current assets / current liabilities

= 1531913 / 834057 = 1.83:1

Working Capital = Current Assets – Current Liabilities

= $ 1531913 – $ 834057 = $697856

The Liquidity ratio provides a brief evaluation and exanimation on the ability of organizations to meet its short terms creditability in the marketplace (Woelfel, 2009). It certainly provides a detailed evaluation of the valuations of the current assets and liabilities of the business entity. The Liquidity ratio is been measured in the two major categories current ratio providing information on balance with current assets and abilities of the company and working capital engages operational cash availabilities to provide information on the accessibility of funds for commencement of functional and operational business activities (Stickney and Weil, 2009). As per the analysis, the current ration of the Harvey Norman has nee estimated 0.14:1 that evaluates a standard balancing within the assets and liabilities of the company. In relation to the working capital of the company, the value estimates $697856 in 2013 stating the company has proper cash availabilities to meet its short-term obligations (HarveynormanHolding.com.au, 2014).

Profitability ratio (In the year 2013)

Gross Profit Margin= Net Income/ Net Sales

= 187946 / 1323481*100 = 14%

Net Profit margin= Gross Profit/ Net Sales

= 379525 / 1323481*100 = 28%

Mathuva (2012) mentioned the particular ratio provides the ability of an organizations to enhance income in competition to the expenditures were made in the different administrable, operational, and production activities of the company. It significantly provides a measurement of performance and growth of the company in the market place. The major ratio used as the gross profit margin and net profit margin those engager’s percentages of business sustainable growth (Khan and Rehman, 2012). Harvey Norman gross profit margin stated to be 14%, assess that the company has made profit growth of 14% in the year of 2013. The net profit margin of the company estimated to be 28% growth rate in the current year. It has been analyzed the company was able to grenade more income than the expenditures (HarveynormanHolding.com.au, 2014).

It has been analyzed that the company has more cash available that can be invested in the business activities in relation to expand the business in the international marketplace to enhance its market share.

Efficiency Ratio (In the year 2013)

Accounts Receivable Turn over’s= Credit sale/ Average net accounts receivable

= 142211 / 1064402 = 0.13:1

Inventories Turnovers = Cost of sales / Net Inventories

= 944229 / 268781 = 3.51:1

According to Stickney and Weil (2009), it is necessary to analyze and evaluate the assets investments in the company as the operational activates of the firm are depended on it. Efficiency ratios analyze and evaluate the ability of an organization to effectively and efficiently utilizing its assets in the business operations and ability to make a proper and appropriate management of the liabilities to measure and control creditability of the firm in the market place Frankel et al. (2010). It has been estimated that the accounts receivable turnover is been estimated 0.13:1 in the current year of 2013, it states that the company is quite able to meet the evaluation of assets been engaged in the production of products. The Inventories turnover of the company evaluates the companies inventories performance is 3.51:1 that is more than the standardized inventory performance that is 2:1. The company is able to sale every inventory within a certain amount of time efficiently to meet the sales target in the current year of 2013 (HarveynormanHolding.com.au, 2014).

Solvency ratio (In the year 2013)

Debt to Equity= Total Liabilities/ Total Equity

= 1701176 / 2363855 = 0.71:1

The solvency ratio provides proper evaluation and analysis of the capital risks being faced by the company by assessment of the equity generations and valuations based on share performances in the stock market. Kheradyar and Ibrahim (2011) observed that the solvency ratio is also termed as the leverage ratio that analyzes the debt or credit level of the company in the marketplace. It has been evaluated that the measurement and evaluation of this ratio provide information noncash availabilities to meet the issues, credits, and payments been due to the firm during the financial period. The analysis states that the debt to equity of the Harvey Norman is valued 0.71:1 in the year of 2013. It analyzed that the company has a low rate of debt or creditability in the market. It has been estimated that it certainly can able to meet its liabilities credited (HarveynormanHolding.com.au, 2014)

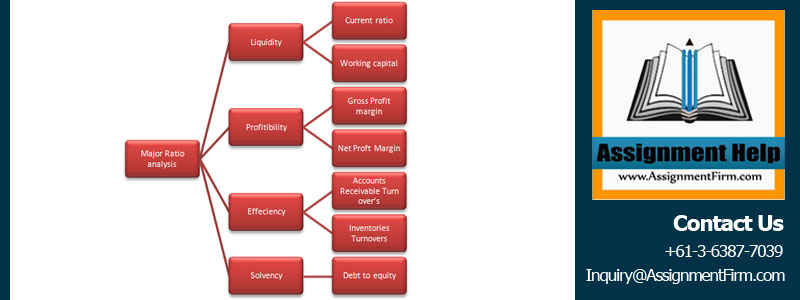

Figure 2: Major Ratio Analysis

(Source: Saeidi and Jorjani, 2012, pp- 119)

f) Evaluation of business performance and recommendations on investment

As per the analysis and evaluation of different reports presented and published by Australian Retail Company Harvey Norman it has been stated that the company has enhanced its business performance in the following year. The director’s report and corporate governance report of the company provide information on different strategic planning that enhances the company operational and production activities to boost its sales and profit generation capabilities (Dandago, 2009). As per the chairman’s report, liquidity position of the company is strong as the current ratio of the company estimate 1.83. It stated that the company can able to meet its creditability in more relevant manner stating a hood business growth in the current year of 2013. The working capital of the company estimated that the company has more cash available in relation to make investments in the company (Mathuva, 2012) The possibilities of investments provide information of increase in business expansions that certainly enhance the share price and market share of the company. As per the profitability, the gross profit of the company has shown a growth of 14% has enhanced its effected ratio of sales of inventories and debt meeting that is 0.71 (HarveynormanHolding.com.au, 2014).

It has elaborated that the company has increased its revenue generations that certainly increase its positioning, brand allocations and market positioning of the company in the near future. Thus, it can be suggested that with the increase in profitability. Strategies implications, strong liquidity rates, and different police to assess and reduce risks certain can increase share pricing and dividend rates for the shareholders. Thus, the investment in the shares of Harvey Limited is certainly profitable and reliable as the share performance is sustainable and increasing inappropriate growth rate in the market.

Conclusion

The different tools, approaches, and techniques of Business Accounting have provided a brief evolution of financial performance of Australian retail company Harvey Norman. It was an ability to analyze chairmen’s report provided relevant issues assessed by company, directors report providing information on different strategic management to be implemented and corporate governance provided rules and responsibilities of board members in the company. The ratio analysis and evaluation have engaged financial health, performance, and positioning of the company that provides a sustainable growth in the market. The information’s provided proper suggestions for good performance and positioning of shares in the stock market that can be opted for profitable investment but differently investors in the company.