Assignment Help: Portfolio Management Group Assignment – Combining Portfolios for Optimising Efficiency

Students in group of 2 members will submit an in-depth research report on individual and

combined efficient frontiers by explaining the process of optimising efficiency in portfolio

formation after conducting an analysis in the following steps:

Part-A: Pre-task for each group member: [This part must be completed by the 6th of

September 2017 and a printed copy is to be submitted to the Convenor in class by

individual student]

Use daily closing prices of securities and/or funds from database (as explained in class

project) for the period from 1 May 2016 to 31 July 2017. Your initial vital task is to select

securities and/or funds wisely with relevant analysis for your individual portfolio with the

goal to optimise risk-return trade-off. The report requires a clear description of the

individual portfolio objectives that are set after consultation with the convenor during

project discussion time in lectures.

ORDER This Assignment NOW And Get Instant Discount

You are also required to download closing price data for the same period for All Ordinaries

Index and daily 90-day BAB rates that can be used as a proxy for risk-free rate.

Requirements for Part-A: (a) after preparing database and analysing specified data,

determine and plot the efficient frontier in a graph (ensure you label the axes) and identify

minimum variance portfolio and optimal risky portfolio. (b) Find daily returns, mean and

standard deviation of daily returns of optimal risky portfolio, and annualise mean and

standard deviation. (c) Submit ONLY RESULTS along with portfolio objectives in hard copy.

Part-B: Task for the group:

(a) Combine two optimal risky portfolios of the group. Find the reward-to-variability

ratios of different combinations (with 10% interval including global minimumvariance

and optimum risky portfolios) of combined portfolio. Compare the results

with the results of All Ordinaries Index for the same period.

(b) If you use the optimum risky portfolio of combined portfolio (of part-a) for all of your

clients, find the weights, expected returns and standard deviations of optimum

complete portfolios for the following three clients whose: (i) A=5, (ii) A=2.5 (iii) A=1

(c) What is the least degree of risk aversion for investors who will not look for leverage?

Prepare a report of 2000 (+/- 10%) words including the following:

1. Reasons for selecting specific security and/or fund in your portfolio.

2. Comment on your portfolio efficient frontier.

3. Comment on the minimum variance portfolio and optimal risky portfolio with respect

to the historical rates of return and standard deviations.

4. Comment on the optimal complete portfolio of three investors.

5. Limitations and strengths of your portfolio.

ORDER This Assignment NOW And Get Instant Discount

Submission Details

Each group is required to submit one HARD COPY and one SOFT COPY of the Final Report.

HARD COPY SUBMISSION:

One student from each group should submit HARD COPY of the assignment including:

I. a print copy of RESULTS (ONLY) of the Excel Spreadsheet file;

II. a print copy of the assignment report;

III. a print copy of all appendices and support documents;

IV. an assignment Cover Sheet signed by both members of the group with their names

and IDs;

SOFT COPY of REPORT SUBMISSION

[via Turnitin on Blackboard]

One student from each group should submit the REPORT via Turnitin.

Turnitin is designed to detect plagiarism in written assignments, not numerical

spreadsheets. Therefore, the file submitted via Turnitin does not need any additional

support files such as Excel spreadsheet material or appendix data files that you may have in the hard copy. Such support material is best submitted as part of your hardcopy.

Students should use the draft option first which will allow them to review their work, and

then submit their final report using the FINAL SUBMIT option.

Once the report is submitted using the Final Submit option, the report cannot be changed,

withdrawn or re-submitted. See Blackboard links for Draft and Final Turnitin links.

IMPORTANT: A copy of the Excel Spreadsheet file with data, analysis,

workings and results should be sent by e-mail to the convenor by the due date and time.

Marking Criteria

Maximum word count: 2000 [+/- 10%] including tables, graphs and diagrams used

within the report. Students must mention the word count on the cover sheet of the

report.

ORDER This Assignment NOW And Get Instant Discount

Referencing style:

Use Harvard style referencing system for the assignment. The referencing should be

accurate and complete including date accessed for online resources.

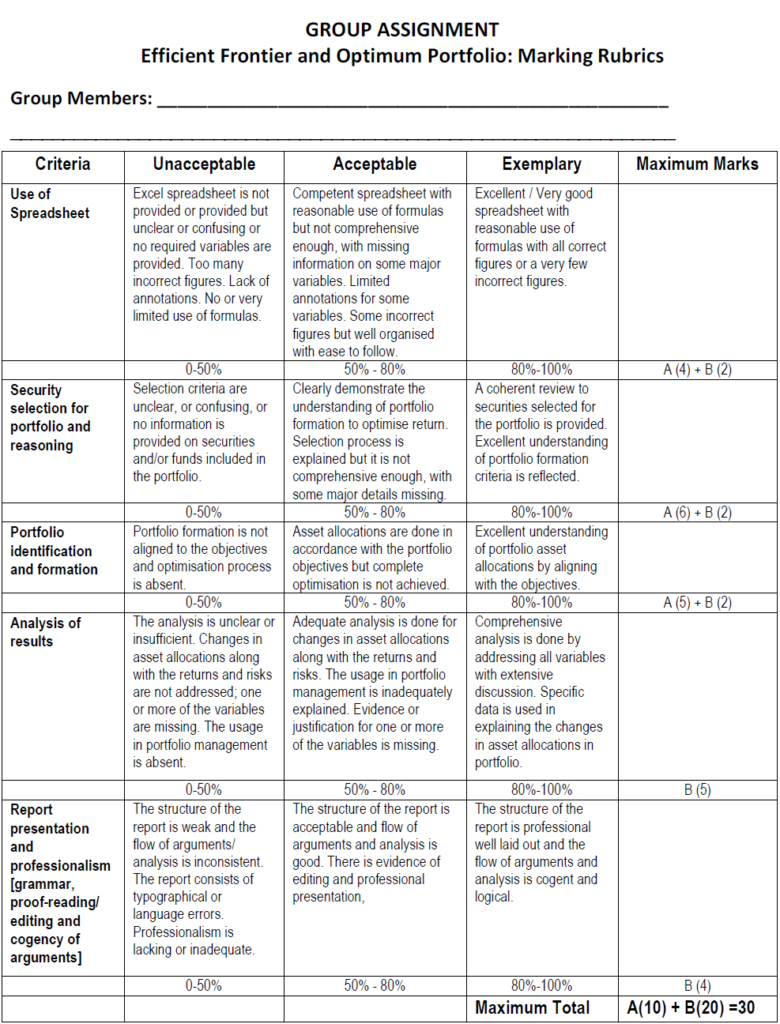

The marking rubrics provided on page-5 should be considered by students when

preparing their assignment for submission.