Introduction to Knowledge Management

IT Based Knowledge Management System is a system that allows an organization in the business environment for managing the knowledge such as a store of information, capture the data and creating support for future development (Jelinek, 2010). In an organization, the system of Knowledge management makes the employees able to access the business facts, identify the resources and make the solutions.

However, it typically allows the company to justify the claims and create proper solutions. For example, in an organisation, through a knowledge management system, an engineer is able to know the process of metallurgical composition for reducing sound in gear system. By sharing this information throughout the organisational behavior, is able to design or construct an effective engine. Sharing of information also helps in improving the equipment of new ideas. In order to conduct this study, the selected organisation is QBE Insurance Company in Australia. QBE operates more than 125 years in Australia and provides the peace of mind to the people of Australia (Qbe.com.au, 2014). The company is known as insurance Group. In the world, QBE Insurance Company is covering the one place out of first 20 insurance companies.

1. General Background of QBE Insurance Company

In 1886, the Robert Philip and James Burns first established the company QBE Insurance Company. In 1890, the company organised over 36 agencies in different locations such as Hong Kong, Europe, Singapore, Pacific Iceland and New Zealand. Moreover, in 1904 the company open new stores in London near about Fenchurch Street. QBE Insurance Company first started their business as a name of North Queensland Insurance Company. In 1924, the company opened a new office in New York. Apart from that, James Burns founded an Insurance company of Bankers and Traders (B&T) in 1921 (Group.qbe.com, 2014). James Burns includes this insurance company with the QBE Insurance Company and make the QBE as the largest shareholder.

In 1959, both the insurance company B&T and QBE purchased more than 40% of General Insurance Company and Equitable Probate. The term Q is taken from the name of North Queensland Insurance Company and B is taken from the Bankers and Traders (B&T) Insurance Company and respectively E is taken from the Equitable Probate Insurance Company. The company ‘QBE Insurance Company’ is becoming the one insurance company out of 20 in the world after established. In each year, the company grows up their gross premium gradually. In 1994, the gross premium of QBE Insurance Company was $1 billion (Group.qbe.com, 2014). Whereas, in 2013 the gross premium of the company is increased high that contains $17 billion.

In Australia, the QBE Insurance Company helps in protecting the people in their all occupations. QBE Insurance Company gives the support to Australians from home to office as well as any other place in life. As time passed, the company grow up their business into sophisticated providers. Generally, the company provides insurance products such as general insurance. According to Stacey (2011), QBE Insurance Company provides the people with nine different categories of general insurance throughout the world. QBE Insurance Company provides the protection to the peoples in several parts of their lifestyles such as homes, workplaces, tourist places etc. Moreover, the company always focused on improving the customer service through the use of latest technology and new idea or products.

The main vision of QBE Insurance Company is to become the most successful insurance providers not only in one country but also globally. In order to increase their insurance policy, QBE Insurance Company focused on improving the services of their customers, shareholders as well as in the community (Group.qbe.com, 2014).

2. Key Knowledge Management area of QBE Insurance Company

In order to succeed in the business and become the world’s top insurance company, QBE Insurance Company implements Learning Management System (LMS) for managing knowledge. Within the business proce4ss of QBE Insurance Company, Learning Management System plays a significant role. Learning Management System helps the company in providing the information that suitable for business to employees distributes the learning and provides relevant training that improves the skills and knowledge to employees (Jelinek, 2010). It helps the employees to take care of their customer’s protection and security in the way that is more significant.

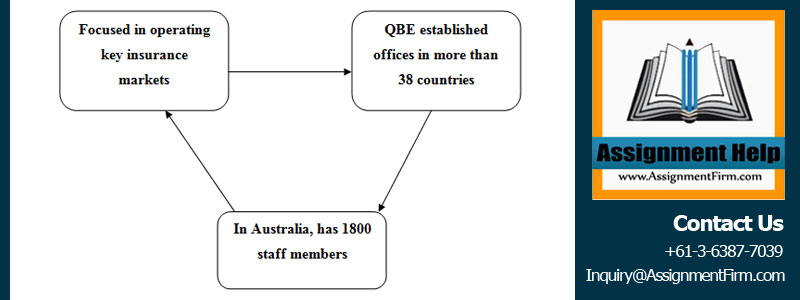

The group of QBE Insurance is the largest general insurance company as well as reinsurance group in Australia. It has more than 25 insurers and reinsurers throughout the world. Implementing the Learning Management System (LMS), QBE Insurance Company provides the major lines of insurance coverage for both commercial and personal risks. In Australia, QBE Insurance Company, have more than 1800 employees. All the staffs take part in national and international operations. Nevertheless, in Australia QBE Insurance Company is taking place the forefront in Insurance Industry.

Learning Management System (LMS) within the QBE Insurance Company delivers the various modes of training such as re-housing training, E-learning content as well as outsourced training for future improvement and growth of the business.

Figure 1: Focused areas of QBE Insurance Company

(Source: Lee & Chen, 2010, pp- 51)

2.1 Business Problem of QBE Insurance Company

As the company spread their business worldwide, they need to manage a large number of regulatory worldwide. In 2002, QBE Insurance Company involved the compliance-driven training in order to meet their business requirements specifically. In order to meet the goal of business and requirements, the management of QBE provides various forms of training processes, delivery mechanism, monitor the overall process and working environment.

Moreover, the management of Insurance Company aligns their learning activities with the objectives of business (Group.qbe.com, 2014). All drivers and process of Learning Management System (LMS) is implementing to manage it. However, QBE Insurance Company is unable to select the proper tracking and learning paths of LMS. It is unable to acquire the competencies of both external agents and internal staffs due to FSRA Compliance requirements.

3. Description of used IT-based tools for knowledge management in QBE Insurance Company

In order to maintain daily report, provide the update information and monitor the overall working performance of QBE Insurance Company, the higher authority implements the Oracle Learning Management System for their staffs. According to Vittal & Shivraj (2009), Learning Management System is the process of documenting, tracking, delivering, and reporting of training programs through the software application.

ORDER This Knowledge Management System Assignment NOW And Get Instant Discount

The management of QBE Insurance Company identifies that Oracle Learning Management System is the best and effective way for improving the workforce performance. However, it ensures the sale as well as service of the company and increases the readiness. In order to improve the skills and knowledge to customer satisfaction, Oracle Learning Management provides require training. As stated by Grant et al. (2009), the Oracle Learning Management (OLM) is one of the effective processes of Learning Management System that helps in delivering, tracking and managing the overall process. Within the workplace of QBE Insurance Company, staffs are able to identify the required learning methods through participating online class.

In QBE Insurance Company, Oracle Learning Management (OLM) works in various purposes. These are –

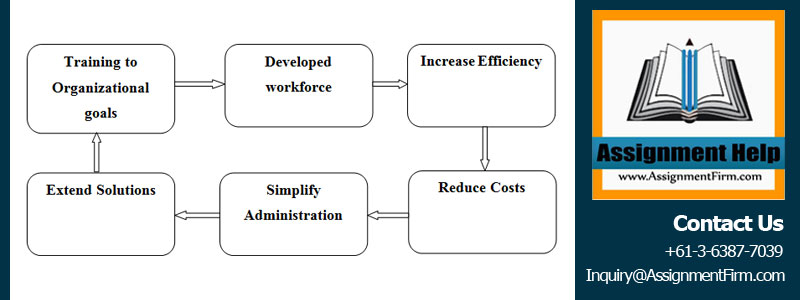

Figure 2: Purpose of Learning Management System at QBE

(Source: Heisig, 2009, pp- 28)

Training to Organisational goals – Oracle Learning Management (OLM) system provides the online and offline training to the staff of the company worldwide. It is also given and training to them in order to measure the effectiveness (Nonaka & Krogh, 2009). However, Oracle Learning Management (OLM) always providing training to staffs of Oracle Learning Management (OLM) based on their goals.

Developed workforce – OLM helps in describing the reusable framework of learning objectives. Moreover, staffs can understand the competencies. The OLM system always updates the competency profiles and helps in planning the certification as well as paths that guide and manage.

Increase Efficiency – OLM system provides the knowledge in assembling and learning the content rapidly usi8ng the4 mixed media and multiple modalities.

Reduce Costs – OLM helps in contacting the people through online and serve the product in online (Rizzi et al. 2009). However, OLM system allows the members of QBE Insurance Company to collaborate with their customers via chats, web conferencing and emails.

Simplify Administration – In a business process of QBE Insurance Company, the OLM system is allowed in creating a different attractive catalogue for understanding to the customer and motivating them to take their service. Moreover, OLM supports the blended learning.

Extend Solutions – The QBE Insurance Company implement OLM system for the learning management system in order to access self-service of the staffs. It allows the staffs to understand the customers and shareholders and make a quick solution to raise problems (Jelinek, 2010).

4. Description of used socialization based tools for knowledge management in QBE Insurance Company

In order to meeting and brainstorming, QBE Insurance Company used E-learning tool. This tool helps in web conferencing with the shareholders and the customer worldwide. In the business process of QBE, E-learning enables the staffs or management to develop a new solution of raised problems, new ideas, training process, and policies. Moreover, it allows them to formal entertainment. Apart from that, using the E-learning tool company covers the huge target market not only in Australia but also throughout the world (Datta & Acar, 2010).

ORDER This Knowledge Management System Assignment NOW And Get Instant Discount

In a consistent manner, it helps in communicating to the customer and shareholders as well as a community through the message. The approach of blended learning helps in producing the higher range of retention knowledge. E-learning social based tool permits in providing update refreshed news to the customers. The most important and helpful impact of E-learning tool in meeting and brainstorming of QBE Insurance Company is savings of money and time. E-learning technology provides the online communication facilities to interact with the customers and shareholders (Ebrahim et al. 2009). Thus, it reduces the time and costs of traveling.

Moreover reduces the extra space for training. Moreover, using the techniques of E-learning in learning management system, QBE track their staff consistency and progress report gradually. The activity and performance also measured by the management in the workplace. This is very useful techniques for future improvement and achieves the goal of the company. Use of E-learning system QBE provides the learning and training season to their employees and improves their skills. Moreover, the management is getting more benefits from the E-learning socialization based tool. From one location, the management of QBE access the data remotely about their staff’s performance and receives the entire process of QBE’s operations.

5. Knowledge sharing climate within QBE Insurance Company

In order to enhance the business growth and achieve more target customers in future, within the workplace of QBE Insurance company tacit knowledge sharing techniques are used. It allows the management to share the new ideas or existing ideas from one service to another. Tacit knowledge sharing techniques help the management in understanding and identifying the proper resources and ideas and transfer of those ideas to staffs make an effective system.

5.1 Incentives for knowledge sharing

In order to share the knowledge, the company uses embedded knowledge system. It helps in scenario planning and hypothesizing the entire workforce within the organization. Moreover, after developing the scenario planning it allows the management of QBE is created structured that gives them a brief process for running the system well. Apart from that, embedded knowledge is functioning directly to mapping the process.

Moreover, in OLM embedded knowledge plays the vital roles of developing and providing guidelines and procedures in order to store and access. However, embedded knowledge involves properly into the IT system and disrupting their existing process along with culture. Li et al. (2011) cited that embedded knowledge supports the routines and practice of Insurance Industry and modify the system according to its own rights.

5.2 Structural roles related to knowledge management

In the IT system in QBE Insurance Company, embedded knowledge plays the major roles. It allows the Chief Executive officer to access the data of their working environment and its culture. Moreover, it helps in understanding the working activity of staff members. For example, in the routine of QBE Insurance Company embedded knowledge provides the rules and regulation that has followed by the staffs.

On the other hand, embedded knowledge provides the working schedule to interact with customers and shareholders (Grant et al. 2009). Rather than the structural knowledge allows the management or chief executive officers to access the past information from storage place.

6. Proposed knowledge management system for QBE Insurance Company

The above study demonstrates that QBE Insurance Company uses the Learning Management System in their business process. It helps in their business operation by providing proper training through online and interacts with the shareholders and customers via web conferencing. However, if the company use Decision Support System (DSS) with the business operation, it will be better and able to provide an effective decision for future improvement.

ORDER This Knowledge Management System Assignment NOW And Get Instant Discount

Decision Support System is one of the valuable tools for managing knowledge in business. In order to maintain the report and providing information to staffs, Decision Support System allows the management effectively and provides the accessibility facilities of information. Nonaka & Krogh (2009) stated that using the DSS in managing knowledge, management of QBE Insurance Company easily share their information and conduct online raining from one location.

As acknowledged by Vittal & Shivraj (2009), DSS saves the time cycle and improve the activity of employees. DSS allows the management of QBE Insurance Company in providing information timely using the computerized system. It demonstrates that employees can get information that is more precious quickly and increase their productivity. On the contrary, DSS using the technology improve the communication process between the management and staffs as well as between the stakeholders and staffs. Data-Driven DSS allows is able to improve the accessibility that progresses the skill of employees.

Promote learning is also an initial quality of DSS. DSS allows the staff to interact with the management regularly and learn about the new ideas. It develops their knowledge and makes them able to develop decision-based on the situation.

For the new employees, DSS provides the de-facto learning process that potentially improves the skill and knowledge. Stacey (2011) mentioned that data-driven DSS make available of data and information on employee’s performance and their informal querying. This helps the management and chief executive of QBE Insurance Company in understanding the operations.

On the other hand, some DSS system provides the summary of information and data on business operation and recommends for a better process. Through DSS, management of QBE Insurance Company may employ better quality staffs and reduce the threats. However, DSS allocates the management of QBE Insurance Company to make a decision with its intelligence system. Furthermore, DSS is allowing in removing the frustration regarding decision-making. However, it creates the perception of better decision making related to QBE Insurance Company’s business.

Conclusion

This study deals with the knowledge management system in QBE Insurance Company business process. Here, described factors are about the background history of the company. The company first start in 1886 in Australia and the name was North Queensland Insurance Company. After that gives a brief description of used knowledge management system (LMS). QBE uses Learning Management System to improve the skills and knowledge via online training. Business problems of the company also mentioned here. Apart from that, recommends Decision Support System (DSS) of managing knowledge for using in operations of QBE Insurance Company.