Introduction: Impact Of Adoptioning IFRS (Horton et al. 2012)

IFRS norms and rules have been used as Accounting Theory Help in different countries all over the world. Countries which are adopting IFRS has improved the disclosure levels more than those countries that did not. IFRS adoption improves the corporate level of the disclosure in all of the countries. Generally, this case study will investigate the impact of adopting IFRS (Horton et al. 2012). Domestic accounting could not ensure the highest level of transparency in the financial report. IFRS ensures the highest quality for listed countries and expected to improve the quality of financial reporting. This assignment deals with the effects of the adoption of IFRS on the financial reporting. In this research study, the researcher discussed the issues of GAAP and how IFRS resolves these issues.

Issues of Australian GAAP:

According to Pinnuck (2012), a single set of high-quality accounting standard provides the different types of advantages such as easier access to foreign countries, and divestitures easier, but in the case of the Australian GAAP, it does not provide any single set of high quality. Earlier in Netherland merchant draft an inventory that listed on the balance sheet, but that is not required as per IFRS norms. Australian GAAP does not provide a higher degree of transparency and comparability to the financial report of the company.

Australian GAAP does not provide cost benefits to the organisation. A business may consist in different countries if the company follows different financial norms, then their cost would be higher. IFRS was adopted all of the companies by the Australia and Hong Kong in the year 2005, adopted IFRS did not happen in the same way in every country (Desk et al. 2012). There are many differences remain between IFRS and Australian GAAP. As per Australian GAAP, companies presented their annual report in different languages that was very crucial for investors to understand the annual report. Generally, the annual report is to communicate to investors and analyse the past and present financial position of the company and based on the past and present position the company planned for the future (Byard et al. 2011). Australian GAAP does not provide any of the a set of high quality, thus it is critical for the companies to attract external investors. If a company does not get sufficient fund to sustain the business management, then the business will go towards the liquidation.

The requirement of IFRS instead of Australian GAAP:

In 2002 the IASB and the FASB develop a common set of high-quality accounts standards that could be used worldwide. The IASB and the FASB follow the principles of the IFRS. Accounting quality in not alone determines by the accounting standards. A firm depends upon the external financial capital, so its responsibility for the organisation to provide a high quality of accounting information and provide useful financial disclosures. Under IFRS the company can provide greater financial quality and serve information to its shareholders. A firm is associated with greater competition in external markets and higher growth opportunities, hence the company needs to implement IFRS converged, that could improve the financial report quality for external investors. That effect could be greater in the manufacturing sector (www.ifrs.org, 2014).

In less developed areas in Australia, require external funds for the companies. Australian GAAP does not follow the international accounting standard, thus it is difficult for the companies to get external fund from outside. Therefore IFRS can help the companies in less developed regions through increasing the quality of the financial report. In this case, Australian GAAP provides the guideline for the company to maintain the accounting standard for the companies. In this case, both of rules have used with balancing standards, but it is not mandatory for those companies that uses IFRS norms.

ORDER This Accounting Theory Help NOW And Get Instant Discount

Palea and Maino (2013) opined that foreign investment plays an important role in Australia’s economic development by supplying capital and expertise. Foreign investors have the information about the disadvantages of the local investors. Therefore the foreign investors are demanding higher transparency. International accounting standard improves the cross border financial statement comparability. Australian firms would improve the financial quality through using IFRS standard into the accountings.

Loss making firms have greater incentives to manipulate earnings of the company. Through using IFRS norms in the loss making organisation could improve the financial reporting quality of the company. IFRS helps to owing the company’s earning management incentives. IFRS norms help the company to manage, time through adopting the IAS or international accounting standard.

The Australian government provides financial subsidies to firms in lines of business by economic development policies of Australia. Firms those receive more grants from the government, they need less external capital, but those firms received does not even received any government grants they should maintain IFRS norms because that will help them to bring external capital from foreign investors (www.aasb.gov.au, 2014).

Qualitative Characteristics of the Financial statement:

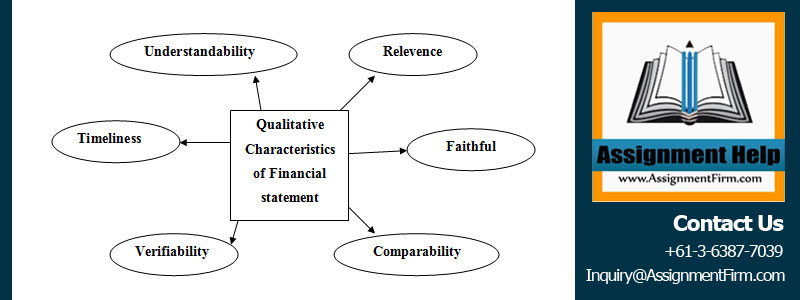

There are mainly six types of qualitative characteristics of financial statements has seen these are relevance, Faithful, comparability, verifiability, timeliness and understandability.

Relevence– Financial statement must be relevant, a relevant financial statement provides greater information to the investors. As the Australian GAAP does not provide relevance accounts statements that provides greater information to the company’s investors. Relevance means predictive value and confirmative value in an accounting report (Bruce et al. 2014). As an example, if the investors conform about its future cash generating ability, then will invest into the company.

Faithful– Faithful in the term represents the agreements between the description and the phenomenon. Australian GAAP also provides faithful, but that is not accepted by international accounting standard. Financial statement must be neutral and free from material error, but Australian GAAP does not ensure the neutrality and material free error (Byard et al. 2011). As per IFRS, faithfully financial statement represents the information must be complete, neutral and free from material error. This is possible if the company follows the norms of IFRS.

ORDER This Accounting Theory Help NOW And Get Instant Discount

Comparability-Comparability is the differences between events and conditions. It is very important for the user to compare among different financial aspects with available resources. Australian GAAP provides comparability among different statements of the accounting period, but that does not provide comparability among different components of the accounts, hence the investors do not get proper information from the account statement (Horton et al. 2012). Setting of accounting standard as per norms of IFRS helps the external investors, to compare among different financial aspects.

Verifiability-Verifiability is the other important characteristics of financial statement. Australian GAAP does not provide fair value in the statement. As per Australian GAAP, in accounting only book value included, for that reason the investors do not get any fair picture of the company (Brown, 2011). On the other hand, as per IFRS norms in accounting statement, difference between book value and actual value reduces. Sometimes it is not easy to measuring the actual cost of the product or assets, IFRS norms provide the guideline for the company to measure the actual or fair value of the assets or product.

Timeliness– Time management is very important at the time of providing information to the external investors. Basically, companies are providing quarterly information to their external investors. Three times, a company forecast its financial statement, quarterly, half yearly and yearly. Australian GAAP and IFRS ensures the company to maintain time and forecast the company’s financial statement (Armstrong et al. 2010).

Understandability– It is very important characteristics of financial statement that every external user must understand the information which has provided in the financial statement of the company. Australian GAAP does not provide such information that help external investors make decisions. In case of non-availability and unclear information does not provide understandable information about the financial position of the company. IFRS helps the company to ensure that the information must be understandable through its principles.

Figure 1: Qualitative Characteristics of Financial statement

(Sources: Armstrong et al. 2010, p-35)

Advantages of IFRS in compare to GAAP:

IFRS is more accurate, compare to the GAAP. A Financial statement that prepare under the IFRS norms to be more understandable for the external investors of the company. IFRS provides important information for external investors that they don’t need to understand the information the other sources.

ORDER This Accounting Theory Help NOW And Get Instant Discount

IFRS reduces the risk for small and new external investors through making standard quality of the financial statement. As IFRS provides understandable information for external investors that helps investors to reduce the risk (Ahmed et al. 2013).

As the financial statement is prepared under the IFRS norms and follows the harmonization, hence the investors don’t need to pay for adjusting the financial statements of the company, on the other hand, Australian GAAP does not provide harmonization. Therefore IFRS indirectly reduces the cost of investors through provides the highest quality of the finance assignment statement.

IFRS provides a single set of high-quality accounting standard provides the different types of advantages such as easier access to foreign countries, on the other hand, Australian GAAP not provides high-quality accounting standard. Most of the countries around 225 countries adopt the IFRS norms, hence IFRS reduces the differences in accounting standards (Lu et al. 2009).

Due to the gap between book value and actual value in Australian GAAP, local investors may affect, but IFRS reduces the gap between book value and actual value that’s helps the local investors. IFRS provides the economic substance rather than legal form, hence the companies and other investors would get fair information about the company.

Conclusion:

IFRS provides a set of high-quality accounting assignment help standard. Many countries use IFRS norms that helped to understand the external investors at the time of decision making. As IFRS is more accurate compared to the Australian GAAP, hence IFRS provides sets of benefits to external investors of the company.