Introduction: Management Of Bentley Hutchins & Associates.

The General Accounting Accepted principles (GAAP) and Australian Accounting Standard Board (AASB) are been established to maintain a proper Financial Reporting. An evaluation and Financial Reporting to provide a close picture of financial positions of business organizations (Gaap.com.au, 2014). The study provides a brief analysis of the management of Bentley Hutchins and Associates makes critical decisions interpretation and gathering information for this financial information on the issues faced by Craig Crafters. In the particular study, there will be a brief analysis discussion and evaluation on the issues of the company listed in Australian Security Exchange (ASX) based on the principles and aspects of AASB, GAAP and Corporate Acts in Australia.

Figure 1: Principles of Accounting

(Source: Hogget et al. 2012, pp- 46)

Part A: Technical Content

Issue 1

As per the case, it has been stated that the profitability has enhanced the valuation and performance of the shares Craig Crafters in the marketplace. The approach has influenced the board of directors of the company to increase investment in the business by $ 7.62 million that increase the goodwill by continuous investments in shares. As per AASB stands, the major issue that is been stated is increasing investments in the shares by directors of the company stating the market is volatile and fluctuating (Picker et al 2013). It is important to acknowledge the performance of share in the market depend upon governmental policies, economic balancing, and other market variables. Thus, the excessive investments in shares might be a risk for the company as market factors, inflations; economic slowdown can create a great loss of the company (Carnegie and Walker, 2007).

Figure 2: Indicators of Share Performance

(Source: Deegan, 2010, pp- 72)

Another issue that is been assured that the creation of goodwill by the vision of future profitability. The GAAP principles elaborate that the Goodwill is not only created based on the profitability investments and share performances in the marketplace. As per the company Act 2001, creating goodwill includes the performance of the company, Customers satisfaction, quality maintainers and product proper selling, consistency, valuable changes (Chua, 2006). Thus, as per the Financial Reporting, the shareholder’s perceptions are incompletely correct that the increase in goodwill of mines can certainly enhance by making only investments on the shares. It is necessary to evaluate and analyze the performance, valuations, productivity of the mines discovered by the company to evaluate the return on the investments made by the company to access the goodwill. Carmen is partly right that the company need to engage more indicators factors and areas of analysis before making decision realities to investments in the shares and increasing the goodwill for the company (Vardon et al. 2007).

Issue 2

The particulate issue arises that of the investments being done it certain effect the downfall of net profit by 10% to 30% that is comparable to the dividends paid to the shareholders in the previous year of Craig Crafters. The GAAP legislations states the profitability and performance are need to be accurately mentioned and published so that the different source of gathering funds for investment in the company can be gained. Although management of the company desire to show the provisions as the dividends paid to the shareholders certainly increase by 12% and will be continued. Puengpipattrakul (2006) mentioned that it is necessary to create a consistency in providing profitable dividends to the shareholders to support the company performance; this states that company has to maintain the 12% for next few years. Thus, the managerial decision to not to elaborate the 15% increment in net profit to shareholders is not that much acceptable as shareholders need explanations on the sudden increase in premises of the company (Ato.gov.au, 2014).

ORDER This Financial Reporting Assignment NOW And Get Instant Discount

As per the AASB, there can be an alternative source prior to not providing provisional information on the net profit and growth prospect to the shareholders that is borrowing funds for the market such as financial institutions and invest in the business areas the management desiring to make growth. As per Lao et al. (2012), the use of a source of funds for investment purposes in the business protects the profit consistency and growth as well as provides proper specifications in maintaining dividends for the shareholders. It justifies that the company can maintain an increase in the profitability by 40% to 60% and investment planning in other functional and operational areas of the business.

Issue 3

As per the evaluation, the income tax is not bee calculated in a correct manner (Roberts, 2010). The GAAP standards state that the section 143 of income tax act evaluated incorrect evaluation of the income tax can be adjusted in a procedure of two major stages. In the first stage, the arithmetic calculations of the taxation need to be evaluated again based on the cost of goods sold, gross rents, gross loyalties, interests, advertisements, depreciation and other expenditures of the company (Gaap.com.au, 2014). Then to evaluate the income being generated by the company and recalculate the income tax return. Provide a notice to the tax department and resubmit the taxations to make adjustments in the financial reporting of the company.

When a Company goes public limited, it is been estimated that it certainly increases the business in the marketplace. The corporate rates in Australia are been stated 45%, the change in the tax system by the public company is necessary as changes in the taxation system enhance high-income possibilities (Russell-Smith et al. 2009).

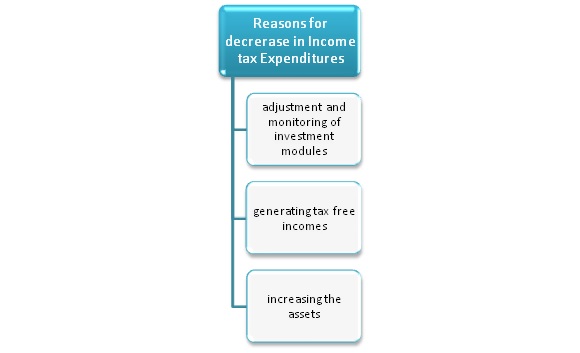

For example- If an Australian company was evaluated 45% of income tax in income generations of $200000 that means income tax certainly be $ 90000 deductibles. In relation to changes in tax as per the public company. The tax deductions based on the 30% of $ 200000 that is a deduction of $ 60000 on income generated by the company. The decline in the tax liabilities or income tax expenditures can result due to generating tax-free incomes by the company, adjustment, and monitoring of investment modules of the company, increasing the assets of the company certainly declines the tax expenditures of the company (Ato.gov.au, 2014).

Figure 3: Reasons for Decrease in Income tax expenditures

(Source: Lao et al. 2012, pp- 32)

Part B Communication Skills

In relation to developing a proper Business Writing Skills, it is necessary to practice certain skills that increase more specific and clear communication between two or more than two professionals. The business letter specifies a proper and good advertising of the capabilities and abilities of an individual to communicate. It engages different techniques and skills such as punctuations to provide a more proper understanding of the sentences wetter, layout to make proper presentation of the business letter, clarified meaning that enhances the knowledge or learning desired to provide to an individual. The business letter writing engages proper structuring that organizes a proper tone and grammar with spelling corrections to enhance the quality style, appearance and presentation of the letter look to be much more attractive. In the appendix, there is proper response in relation to the letter provided by Carmen of Craig Crafts to discuss and solute the issues by the management related to finances and accounting of the company based on AASB and GAAP. The business letter responded in relations to the issues and problems been shared by Craig Craft management

ORDER This Financial Reporting Assignment NOW And Get Instant Discount

Conclusion

The particular Financial Reporting engages the principles, approaches, standardizations of GAAP, Company Act 2001, AASB, and Australian Income Tax in relation to critically evaluate and analyze major financial issues that is been faced Carmen of Crafter Limited. The issues discussed as based on the share investments, goodwill valuations, provisions on mentioning profitability in financial staminate and income tax analysis assessment and implications. There are certain findings been also states as per the issues been analyze and evaluated in the prospect of Bentley Hutchins and Associates.