Explanations: The consolidation in Corporate Accounting Assignment is done by adding both the companies figure. The loan given to Mille Ltd by Max Ltd is not taken into account. The dividend declared by mile prior to acquisition is not taken into account but after the acquisition, it is counted (www.pwc.com, 2014).

For inadequate data the acquisition analysis and changes in equity are not done. However, for acquisition analysis, the tangible asset, intangible asset, non-controlling interest, consideration paid, goodwill or bargain purchase gain is measured.

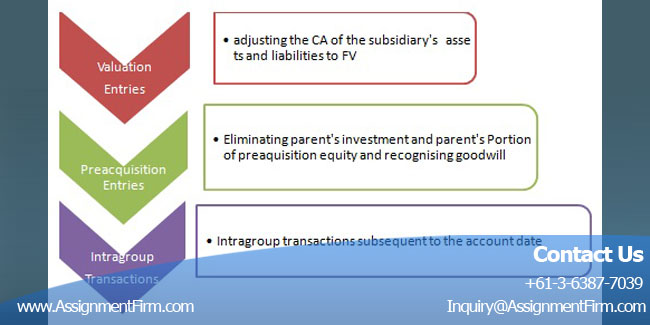

1.The whole picture of BCVR:

The valuation entries, pre-acquisition transactions and the intra-group transactions are done over consolidated worksheet but not on the records of the subsidiary in Corporate Accounting Assignment. One pictorial representation of BCVR adjustment is given below.

2. Fair Value Adjustment in consolidation:

The adjustment between the differences within carrying amount and fair value must be properly done. These adjustments are not directly made on subsidiaries books but on consolidation. Adjustments of fair value are in the form of DR Asset CR Deferred Tax Liability (Munter et al.2013)

3. Item recognition absent in subsidiaries books:

The contingent liability and intangible assets should be recognised to full amount of fair values if they can be reliably measured. They are recognised on consolidation, but not on subsidiaries books. DR Asset CR BCVR CR DTL is the form of existing asset recognition. Contingent liability recognition should be in the form of DR BCVR DR Deferred Tax Asset (DTA) CR Contingent Liability.

4. Consequential Adjustment:

Cost of sales of the subsidiary should be lesser than consolidation. The depreciation amount of subsidiary is to be lesser than the group. However the gain on sale of land is higher than the group. In case of Inventory adjustment to the transfer of BCVR account is done on the period of sale, after that it should be net off into PAE. In case study help of contingent liability, it is derecognized and the rest is same (Munter et al.2013)

5. Pre-acquisition equities at the date of acquisition:

At the acquisition date, the equity balances the assets, liabilities and contingent liabilities. The opening retained profit, the share capital and the other reserves with BCVR are pertinent only if the acquisition is at the starting of the acquisition. Pre-acquisition equity balances should be eliminated from investment and post acquisition profits and reserves should be consolidated.

6. Shares acquired cum dividend:

The dividend are payable to the parent as the new owner of the share. The dividend receivable acquired by the parent is excluded from the cost of the combination. At acquisition date the consolidation should eliminate the dividend receivable and dividend payable between the parent and subsidiary (Deans, 2011).

7. Different transfers between pre-acquisition reserves:

Say the subsidiary has a general reserve of 20000 at acquisition date which is transferred to retained profit during the period:

ORDER This Corporate Accounting Assignment And Get Instant Discount

DR General reserve £ 20000 will be included in the PAE for consolidation. The PAE for consolidation includes the DR Transfer General Reserve £ 20000 when the transfer is in the current period. The PAE considers the DR Retained Earnings (Opening) £ 20000 when the transfer is in the previous period.

8. Pre-acquisition dividend declared and paid:

The carrying amount of the pre-acquisition profits and investments of the subsidiary are reduced. In the subsidiaries books which are a dividend, that is ROI to the parent.

9. Consideration of date:

If the reporting dates are different between parent and subsidiary, the subsidiary should make adjusted financial statement as the parents reporting date is mentioned. Fair values of identifiable assets, liabilities and contingent liabilities are calculated as on the acquisition date; however the cost of combination is calculated on date of exchange. Subsidiary should record goodwill at acquisition date (Needles et al.2010)

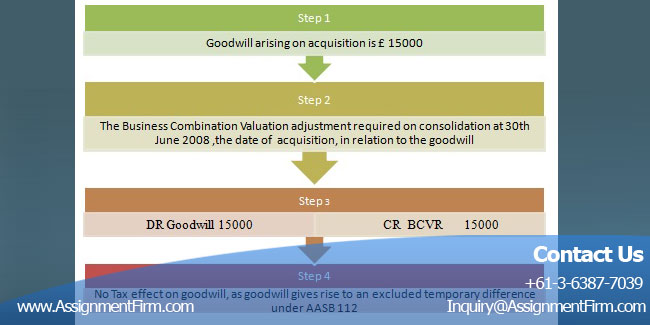

Example of Goodwill Adjustment:

10. Cash flow Changes:

The consolidated statement of cash flows shall disclose the cash flows of the economic entity for the financial year for Corporate Accounting Assignment and shall be prepared on the basis set out in Accounting Standard AASB 1026: Statement of Cash Flows (Alfredson et al. 2010)

In preparing a consolidated statement of cash flows, amounts included in respect of the economic entity, especially in relation to subsidiaries entering or leaving the economic entity, shall be determined in accordance with the standards AASB 1024.