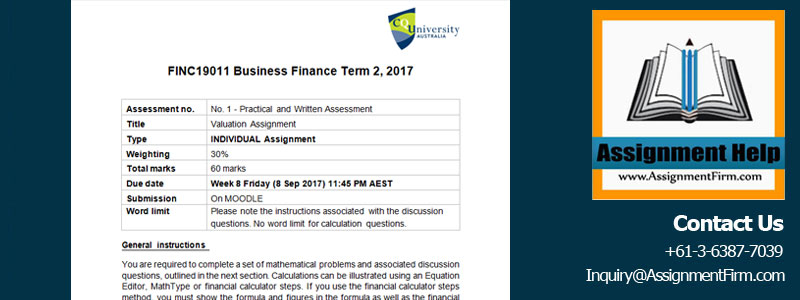

FINC19011 Business Finance Term 2, 2017

Title: Valuation Assignment

Type: INDIVIDUAL Assignment

Weighting : 30% Total

Marks: 60 marks

You are required to complete a set of mathematical problems and associated discussion questions, outlined in the next section. Calculations can be illustrated using an Equation Editor, MathType or financial calculator steps. If you use the financial calculator steps method, you must show the formula and figures in the formula as well as the financial calculator steps. Assignment without any workings will be penalised.

All assignments should be typed and professionally presented. You can use Microsoft Word to complete your assignment and clearly label your questions to make the marking process more efficient. A title page is required and should include your name and ID number.

If you use any articles, textbooks, journals etc. to support your decisions, you must use in-text referencing to properly acknowledge the work of the original author. The preferred referencing style is the Harvard referencing style (author-date). However, you are not expected to reference the formulae.

Do not round until the final answer is reached and then show answers to two decimal places. If the answer is a percentage, convert from decimal format to percentage.

FINC19011 Business Finance

Marking

Marks will be allocated for this assignment for meeting the following requirements:

- Completeness of submitted assignment – all required parts submitted

- Accuracy of the calculations and explanations

- Presentation: clearly and neatly labeled answers to each question; no spelling, typing or grammatical errors; and appropriately referenced if required.

- References to proper sources in the case of discussions

Note: Ensure you include the formulae, figures inserted into the formulae and then your calculation steps used (either financial calculator steps or further steps using the equation). Answers need to be shown appropriately e.g. if a percentage, show to two decimal places such as 12.25%; if $ and cents, show as either whole dollars $50,000 or $50,000.00 (2 decimal places only).

The questions you need to answer are indicated in the following pages.

FINC19011 Business Finance

Question 1 (Portfolio Valuation) (20 marks)

Requirement (a)

Whenever an asset is added to a portfolio, the total risk of the portfolio will be reduced provided the returns of the asset and the portfolio are less than perfectly correlated. Discuss.

Requirement (b)

Minco Ltd, a large mining company, provides a superannuation fund for its employees. The fund’s manager says: ‘We know the mining industry well, so we feel comfortable investing most of the fund in a portfolio of mining company shares’. Advise Minco’s employees on whether to endorse the fund’s investment policy.

(6 marks) (approx 200 words)

Requirement (c)

ORDER This FINC19011 Business Finance Assignment NOW And Get Instant Discount

Harry Jones has invested one-third of his funds in Share 1 and two-thirds of his funds in Share 2. His assessment of each investment is as follows:

| Share 1 | Share 2 | ||

| Expected return | 15% | 21% | |

| Standard deviation | 18% | 25% | |

| Correlation between the returns | 0.5 | ||

- What are the expected return and the standard deviation of return on Harry’s portfolio?

- Recalculate the expected return and the standard deviation of return on Harry’s portfolio where the correlation between the returns is 0.

- Recalculate the expected return and the standard deviation of return on Harry’s portfolio where the correlation between the returns is 1.0.

- Is Harry better or worse off as a result of investing in two securities rather than in one security?

ORDER This FINC19011 Business Finance Assignment NOW And Get Instant Discount

FINC19011 Business Finance

Question 2 (Bond Valuation) (20 marks)

Requirement (a)

Why are bond prices and yields inversely related? Doesn’t a higher yield make a bond more attractive to investors and hence make it worth more, not less?

(6 marks) (approx 200 words)

Requirement (b)

Differences between the current yields on different bonds can be explained by their relative riskiness and different terms to maturity. Discuss.

(6 marks) (approx 200 words)

Requirement (c)

Jeremy Kohn is planning to invest in a $1,000 10-year bond that pays a 12 percent coupon. The current market rate for similar bonds is 9 percent. Assume semi-annual coupon payments. What is the maximum price that should be paid for this bond? (2 marks)

Requirement (d)

Shawna Carter wants to invest her recent bonus in a $1,000 four-year bond that pays a coupon of 11 percent semi-annually. The bonds are selling at $962.13 today. If she buys this bond and holds it to maturity, what would be her yield?

Requirement (e)

Jorge Cabrera paid $ 980 for a $1,000 15-year bond 10 years ago. The bond pays a coupon of 10 percent semi-annually. Today, the bond is priced at $1,054.36. If he sold the bond today, what would be his realised yield?

FINC19011 Business Finance

Question 3 (Share Valuation) (20 marks)

Requirement (a)

The valuation of a share using the dividend growth model is very sensitive to the forecast of the dividend growth rate. This feature is a serious limitation on its usefulness to a share analyst. Discuss.

Requirement (b)

The required rate of return on the shares in the companies identified in (a) to (c) below is 15 per cent per annum. Calculate the current share price in each case.

- The current earnings per share of Zero Ltd are $1.50. The company does not reinvest any of its earnings, which are expected to remain constant.

- b) Speedy Ltd’s current dividend per share is 80 cents. This dividend is expected to grow at 5 per cent per annum.

- Reduction Ltd’s current dividend per share is 60 cents. The dividend of the company has been growing at 12 per cent per annum in recent years, a rate expected to be maintained for a further 3 years. It is expected that the growth rate will then decline to 5 per cent per annum and remain at that level indefinitely.

Requirement (c)

ORDER This FINC19011 Business Finance Assignment NOW And Get Instant Discount

Pioneer Ltd’s preference shares are selling for $33 each and pay a $3.60 annual dividend.

- What is the expected rate of return on a preference share?

- If a preference share investor’s required rate of return is 10% p.a., what is the value of the preference share for the investor?

- Should the investor purchase Pioneer Ltd’s preference shares?

(1 mark each) (3 marks in total)

Requirement (d)

Stag Company will pay dividends of $4.75, $ 5.25, $5.75, and $7 for the next four years. Thereafter, the company expects its growth rate to be at a constant rate of 7 percent. If the required rate of return is 15 percent, what is the current market price of the