Unit Code: HI5002

Unit Name: Finance for Business

Value: 30 %

Venue: HOLMES Institute

Description: HI5002 Finance for Business Assignment Help HOLMES Institute

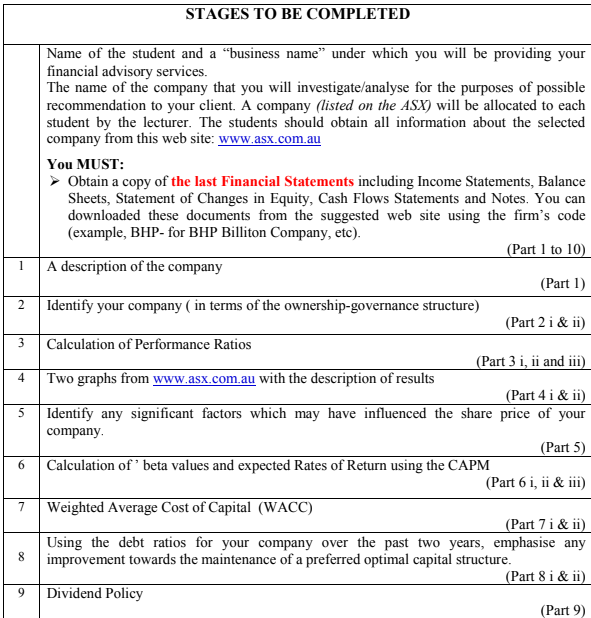

Students are required to study, undertake research, analyse and conduct academic work within the areas of business finance covered in learning materials 1 to 10 inclusive. The assignment should examine the main issues, including underlying theories, implement performance measures used and explain the firm financial performance. You are strongly advised to reference professional websites, journal articles and text books in this assignment (case study).

Required:

This assessment task is a written report and analysis of the financial performance of a selected company in order to provide financial advice to a wealthy investor. It needs to be completed individually. It will be based on financial reports of a listed company on the ASX (chosen by the lecturer).

ORDER This HI5002 Finance for Business Assignment NOW And Get Instant Discount

QUESTIONS

You are an investment adviser, working to build a foundation of wealth for your clients. One of your wealthiest clients already has a diversified portfolio, which includes managed funds, property; cash/fixed interest and a few direct share investments in Australia and around the world. The investor wishes to expand his/her portfolio and is considering your company’s share to add to the portfolio. (The investor has an extra $10 million that wishes to invest into your company). The company which you will examine is allocated by your lecturer.

The assignment is a written comprehensive report and analysis of the firms’ financial performance (including referencing). 100 marks

You are required to do the following tasks:

1. Prepare a brief description of the company, outlining the core activities, the market(s) in which it operates within and any factors in the companies’ history which you consider help present a “picture” of your company. 4 marks

2. Specify ownership-governance structure of the company:

i) Name the main substantial shareholders:

- With higher than 20.00% of shareholdings. Based on this argument you should classify a firm as a family or non-family company, and

- With higher than 5.00% of shareholdings. 3 marks

ii) Name the main people involved in the firm governance:

- The Chairman

- Board members

- CEO.o Whether any of these people have the same surname as any of

substantial shareholders (>20% share capital). If yes- you could use this as an argument for the presence of an owner or family member(s) in the firm’s governance.o Whether any of shareholders with more than 5% share capital are

involved in firm governance. 3 marks

3. Calculate the following key ratios for your selected company for the past 4 years.

Annual reports are accessible via company websites (show all working out):

i) Return on Assets (ROA) = (NPAT / Total Assets)

Return on Equity (ROE) = (Net Profit After Tax / Ordinary Equity)

Debt Ratio = Total Liabilities / Total Assets

EBIT x NPAT x TA = NPAT

TA EBIT OE OE

Be sure that you have “proven” the above equation. 12 marks

ii) Explain what phenomenon is being “captured” by the variable TA/OE, and how it is impacting on the relationship between Return on Assets and Return on Owners Equity. 4 marks

iii) Explain why the ROE (EBIT) is significantly greater than or less than the ROA (EBIT). 4 marks

4. Using the information from the ASX website: www.asx.com.au you must complete the following tasks:

i) Prepare a graph / chart for movements in the monthly share price over the last two years for the company that you are investigating. Plot them against movements in the All Ordinaries Index. 6 marks

ii) Write a report which compares movements in the companies’ share price index to the All Ords Index. For instance, how closely correlated is the line with the All Ords Index. Above or below? More or less volatile?

ORDER This HI5002 Finance for Business Assignment NOW And Get Instant Discount

5. Research via the internet or financial/business publications:

From research via the internet (using credible sources) or financial/business publications, note any significant announcements which may have influenced the share price of your company. These factors could include merger activities, divestitures, changes in management’s earnings forecasts, changes in analysts’ forecasts, unusual write-offs or abnormal items, macroeconomic factors, industry wide factors, significant management changes, changes in the focus of the company, impact of competitors or law suits etc. (Restrict the number of announcements to 5). 10 marks

6. Go online to http://www.reuters.com/finance/stocks/ and type in the code for your company into the Search Stocks field and click on the magnifying glass button.

i) What is their calculated beta (β) for your company? 2 marks

ii) If the risk free rate is 4% and the market risk premium is 6%, use the Capital Asset Pricing Model (CAPM) to calculate the required rate of return for the companies’ shares. 4 marks

iii) Is the company you have chosen a “conservative” investment? Explain your answer. 2 marks

7. Weighted Average Cost of Capital (WACC)

i) Using information from the latest company report for the company (i.e. interest rate on their major source of long-term loans) and the estimated cost of equity capital calculated (in part 6ii above), calculate the WACC for your company. 6 marks

ii) Explain the implications that a higher WACC has on management’s evaluation on prospective investment projects. 4 marks

8. Consider the debt ratio for your company over the past two years:

i) Does it appear to be working towards the maintenance of a preferred optimal capital structure? (i.e., does it appear to be “stable”?). Explain your answer. 4 marks

ii) What have they done to adjust/amend their gearing ratio? Increase or repay borrowings? Issue or buy back shares? Has the Director’s Report given any information as to why they have made any adjustments? 4 marks

9. Dividend policy

Discuss what dividend policy of the management of the company appears to beimplemented. Explain any reason related to that particular dividend policy. 7 marks

10. Based on your analysis above, write a letter of recommendation to your client, providing an explanation as why you would like to include this company in his/her investment portfolio. Please refer to the ratio results calculated earlier and any other trends or factors that you believe to be important. 10 marks

11. Formal structure and referencing.5 marks

__________________

Total = 100 Marks

GENERAL REQUIREMENTS

- The report must have an academic written structure including an introduction, body and conclusion.

- This assignment must be completed INDIVIDUALLY.

- Use numbers in the body of the report (e.g., “5. Research via the internet”).

- Provide an explanation on each of these issues (points) and explain how they confirm the underlying theory, particularly related to the ownership, financial measures, risk-return, capital structure and dividend policy.

- You are required to submit the assignment on Blackboard

- You are required to submit this assignment to Turnitin. Please ensure the similarity score is under 15%.

Presentation of written work

• Please submit your assignment on time (Week 11).

• Please make sure that your name and surname (student ID), subject name, and code and lecture’s name are written on the cover sheet of the submitted assignment.

• You are required to use Times New Roman font, size 12 with 1.5 line

spacing.

• Please insert page numbers into your assignment.

• Please use 3 cm margins.

• Submitted work should be your original work showing your creativity.

• Always keep an electronic copy until you have received the final grade for the Unit.

A high standard of work is always expected, so poorly presented work may bereturned unmarked with a request to re-submit.

Rules apply for electronic submission. When you submit your assignment electronically, please save the file as ‘Assessment Task 1.doc’.

ORDER This HI5002 Finance for Business Assignment NOW And Get Instant Discount

Get ACC3004/ACC104 Portfolio of Business Finance Issues Assignment written by experts.

Get BUS101 INTRODUCTION TO BUSINESS LAW CASE STUDY written by experts.