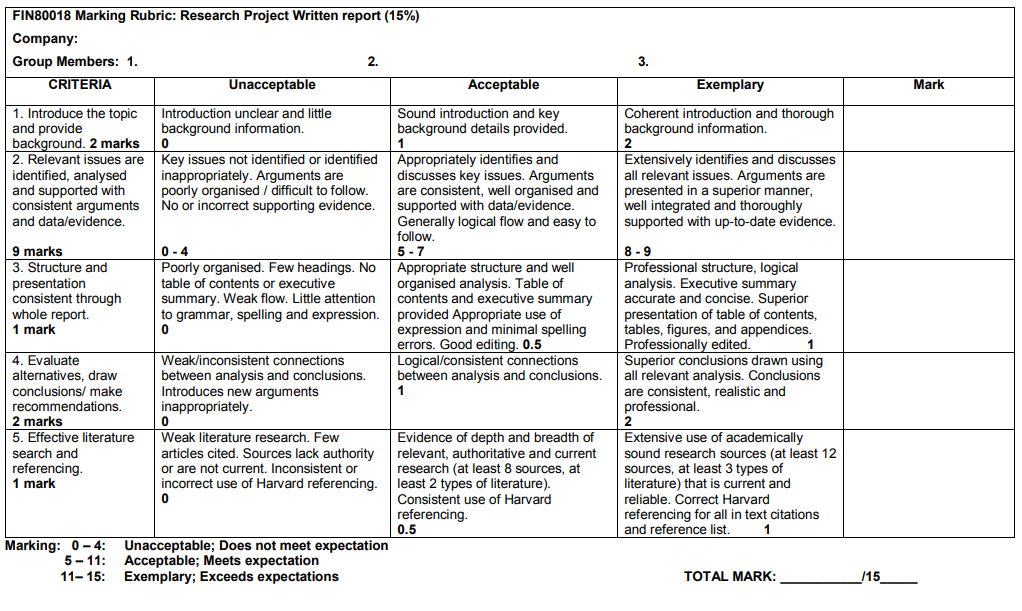

Presentation (5%)

Written report (15%)

Assume that your team has recently been appointed as the “Financial Risk Management” team of your organisation. For this purpose, select a company of your choice (companies will be allocated to each group in the first class) and assess how well the company manages its risk by addressing the following issues. Your team has been requested to prepare a report to present to the board.

Section I (5 marks)- FIN80018 Financial Risk Management Assignment Help

(a) Identify the primary financial risks that your company is exposed to. For this purpose

asset and liability structures need to be considered. In this section, you MUST discuss the

outlook for each variable and the related risk exposure.

Section II (5 marks)

(b) Make firm recommendations on whether to hedge all, part or none of the financial risk exposures that you identified in part (a) above. You MUST provide some explanation

for each of your recommendations. You need to explain whether your hedging strategy is

in accordance with the current strategy of the company and the reasons for suggesting this

strategy. (You are not required to specify the type of derivative to be used to hedge in

response to this question). (3 marks)

(c) To make recommendations on which derivative instruments (for example, options, futures etc.) to use to implement any hedges that you have recommended in part (b) above. Once again, you MUST explain your recommendations. This means that you will need to provide very well researched and fully explained reasons for your responses to part (b). However, it is advised that you make at least some hedge recommendations to

make responses to parts (c) and (d) more meaningful]. You are NOT required to propose

details of how to implement your hedge recommendations in this part – this is to be done in part (d). (2 marks)

ORDER This FIN80018 Financial Risk Management Assignment NOW And Get Instant Discount

Section III (5 marks)

(d) To propose, in accordance with each of your recommendations in (c) above, specific

hedging strategies which require you to describe the following:

i. the exposures to be hedged,

ii. what percentage proportion of the exposure is to be hedged,

iii. which derivative(s) are to be used to hedge each exposure,

iv. the number of derivative contracts for each hedge,

v. the delivery months (or duration of swaps) for each derivative, and

vi. the prices at the time of making the recommendation – futures prices, option strike

prices (including an explanation of the choice of strike price(s)] and the interest

rate for currency swaps (you will need to research this- use actual data).

For part (d) you may assume that the hedge horizon is mid-December and that you

can use futures and options with a December expiration date for hedging. Also, in part (d) if you recommend option strategies you may also wish to consider strategies that require the ‘purchase and sale’ of two different options (e.g. an option spread) to reduce the cost of the option strategy. In this section you MUST show all calculations and include your responses in a table format. (3 marks)

(e) Is the company adequately hedged? Why or why not? What are your recommendations?

(2 marks)

(5 + 5 + 5 = 15 marks) – Written Report / (5 marks) – Presentation (10 mins)

Submission Requirements : FIN80018 Financial Risk Management Assignment Solution

1. You MUST submit the assignment via turnitin. Check the draft in the “draft submission” link before doing the final submission.

2. Please retain a copy of your work.

3. An assignment cover sheet must be attached to your submission (see blackboard for

assignment cover sheet).

4. Note that the allocated marks are a guide for you to decide the weight placed on each part. However, the case study will be marked out of 100 and converted to a mark out of 15.

5. Please see marking rubric on page 4.

Your submission is to take the form of a research report. It should be concise, spell-checked for obvious errors, edited, professional and be clearly expressed. The assignment should include the following sections:

Executive Summary, Introduction (brief), body (where you will answer parts to the

assignment), conclusion (brief), References, Appendices (optional)