General Facts:

Scott Wright is 36 years old and is an Australian resident for tax purposes. Scott is an employee teacher working for Launceston Secondary College. Scott has been working as an English teacher since he completed his Diploma of Education degree fifteen years ago. He lives in a house in Newnham, is single,and has no dependents.

BFA714 Australian Tax Law Assignment-Tasmania University.

Scott has supplied you with the information below relating to his personal income tax affairs for the year ended 30 June 2020. However, he is not certain whether everything he has provided you with is assessable or deductible. He has asked you to consider each item and determine whether it is assessable or deductible.

Scott wishes to minimise his 2019/20 taxable income wherever legally possible. Assume that the amounts detailed below are all of Scott’s receipts and expenditure for the 2019/20 income year, and that all of his expenses are correctly substantiated (unless otherwise stated).

1.Personal information

Full Name: Scott Wright

Date of Birth: 2 October 1983

Main occupation: Teacher

2.2019/20 income tax return

On 1 February 2020, Scott received an invoice (dated 30 January 2020) for $480 from ‘Swift Tax Returns’ for their work in completing his 2018/19 income tax return. Scott paid this on 2 March 2020.

Scott’s 2018/19 notice of assessment showed he had additional income tax payable of $2,030. As Scott paid this amount late (on 2 May 2020), the Australian Taxation Office imposed $189 in general interest charges (GIC), which Scott also paid on 2 May 2020.

BFA714 Australian Tax Law Assignment-Tasmania University.

3.Salary and Wages

For the entire 2019/20 income year, Scott worked as an employee teacher for Launceston Secondary College.

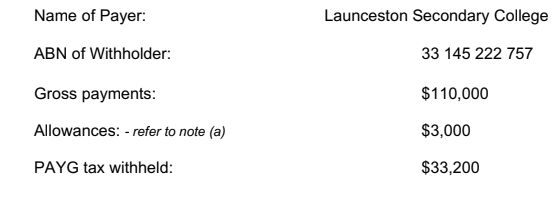

The school provided Scott with a PAYG Payment Summary for the period 1 July 2019 to 30 June 2020, which contained the following information:

Note:

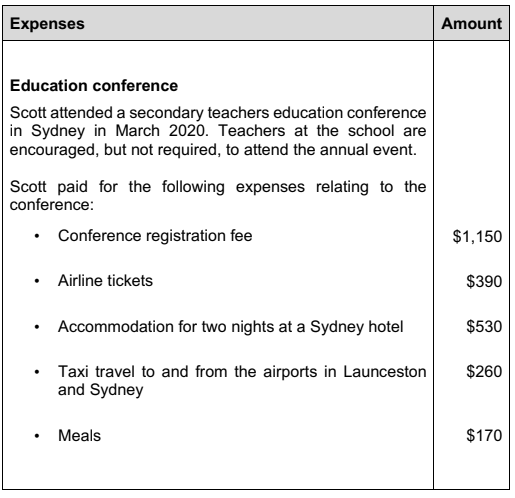

(a) The allowance (of $3,000) is made of up of the following:

- a phone allowance of $500

- a professional development allowance of $2,500 (to attend education conferences, workshops, etc).

4.Interest

Scott maintains one bank account. He provides you with the following information about interest earned during the 2019/20 income year:

- CBA transaction account (gross interest) – refer to note (a)

Notes:

(a) The CBA bank account is Scott’s transaction account where his fortnightly pay from the school is deposited. Scott provided his tax file number (TFN) to the bank.

5.Unexpected receipts

During the 2019/20 income year, Scott also received the following:

(a) A $50 Myer voucher from the principal of the school. All teachers received the same gift on the last school day of 2019, and it was enclosed in a card with a personal message that thanked Scott for his excellent teaching throughout the year.

(b) Scott received $120 ($115 net after deducting his $5 ticket cost) in the school’s ‘Melbourne Cup sweep’. He is unsure whether this should be declared in his taxable income, given that he enters this competition every year and is concerned that it might therefore be a recurrent receipt.

6.Royalty receipt

Scott receives royalties from the publisher of his book “Effective history teaching”, which has a recommended retail price of $35. For each book sold, Scott receives a royalty of $4 from the book publisher.

On 2 July 2020, Scott received a letter from the publisher stating that based on book sales for the 2019/20 financial year he is entitled to royalties of $1,060 (based on the sale of 265 books). The publisher deposited this amount directly into Scott’s bank account on 30 June 2020.

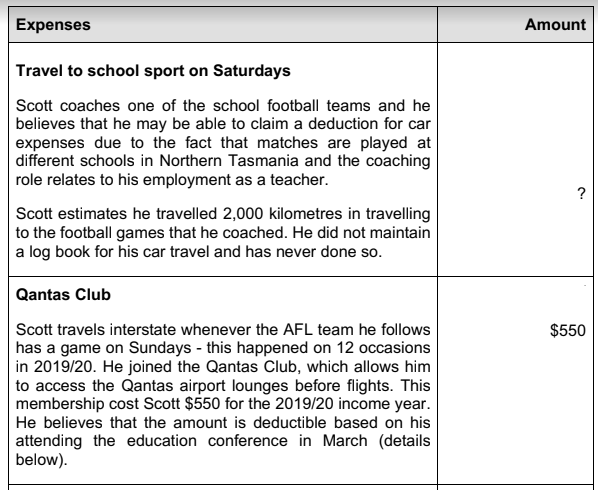

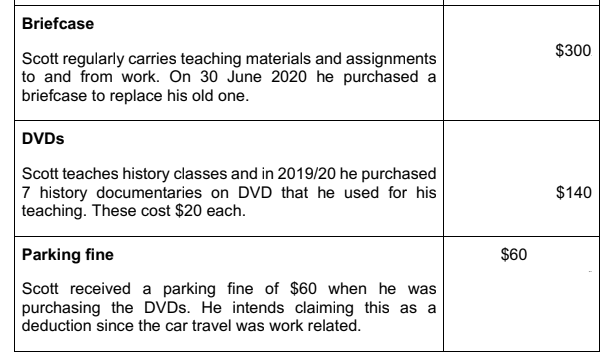

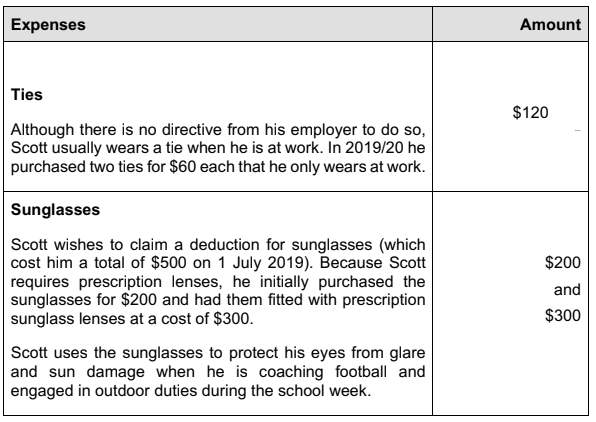

7.Expenses

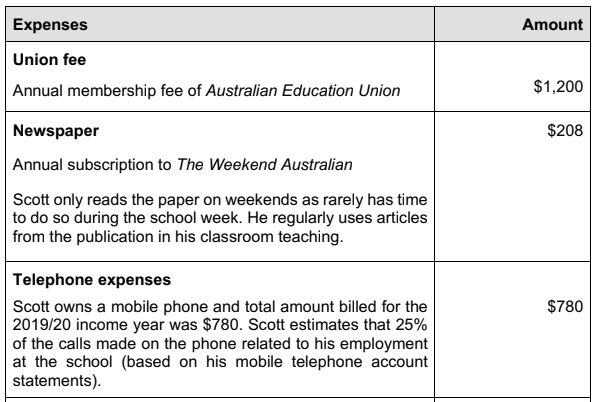

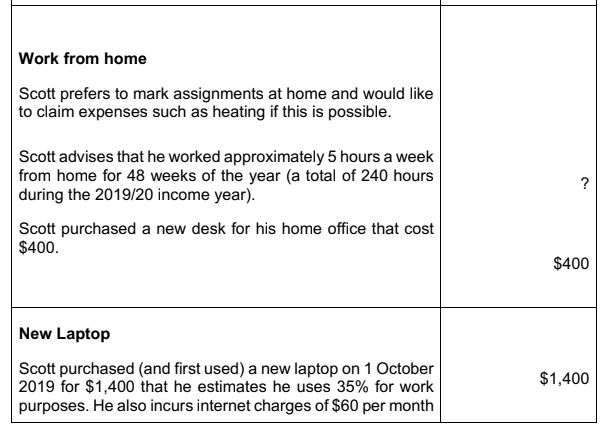

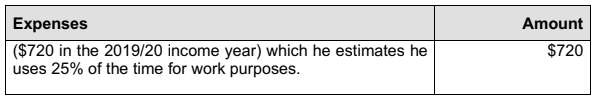

During the 2019/20 income year Scott incurred the following expenses that he believes are related to his employment as teacher and deductible. Scott advises that he has retained receipts for all of the following expenses:

8.Additional information

- For any capital allowance entitlements, Scott prefers to use the diminishing value method.

- Assume that all expenses include GST where relevant.

- Scott does not have any health insurance.

For each of the items referred to, your answer should state whether it is

assessable/deductible or not, the amount and you should include a source of

law wherever possible (e.g. a section of the Act or the name of a case; ATO

Rulings can also be cited).

The final part of your assignment answer will be a calculation of the tax

payable/refundable.

BFA714 Australian Tax Law Assignment-Tasmania University.