This assignment will contribute 20% of your total grade.

The raw total marks for this assignment is 50 marks.

ASSIGNMENT : ACC2350 COST ACCOUNTING II Assignment

Question 1 (12 marks)

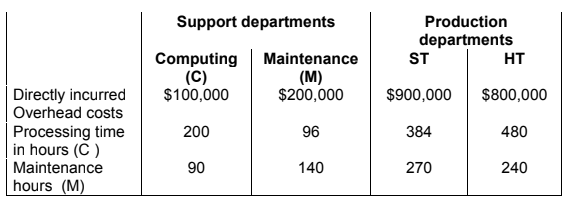

Lectures 4, Chapter 13- Support department cost allocation Central Materials Testing (CMT) Ltd conducts two kinds of tests on materials used for the building industry. It has two support departments, Computing (C) and Maintenance (M) with allocation bases of processing time and maintenance hours, respectively. The two production departments are Stress testing (ST) and Heat Testing (HT). The data for the support and production departments for the month of May are given in the table below:

Required:

1. Assuming Central Materials Testing (CMT) uses the direct method:

a. calculate the usage ratios (round answers to 2 decimal places) for the two

support departments; and (2 marks)

b. the total overhead costs for each department after allocation of both support

department costs. (3 marks)

2. Assuming Central Materials Testing (CMT) uses the step-down or sequential

method:

a. calculate the usage ratios (round answers to 2 decimal places) for the two

support departments; and (3 marks)

b. the total overhead costs for each department after allocation of both support

department costs (4 marks)

ORDER This ACC2350 COST ACCOUNTING II Assignment NOW And Get Instant Discount

Question 2 (15 marks)

Lecture 5, Chapter 5- Job Costing & Lecture 6, Chapter 6-ABC

Vitality Limited manufactures two vitamin products, Complex-B and Vita-C. Vitality’s

cost accountant has recommended that the company adopts Activity-based accounting (ABC) to allocate overheads and she provides the breakdown of the overheads by activity and also data about estimated activity levels in total and for each product. The activity cost driver (allocation base) for General factory is direct labour-hour.

Required:

1. Calculate the activity rates. (3 marks)

2. Using ABC, calculate:

a. total overheads allocated to each product; and (4 marks)

b. unit overhead for each product. 30,000 units of Complex-B and 50,000

units of Vita-C were manufactured during the year. (2 marks)

c. the amount of overhead costs under- or over-allocated for each activity and in total for all activities, specifying clearly whether the amount is under- allocated or over-allocated. (6 marks)

Question 3 (16 marks)

Lecture 9, Chapter 3- CVP

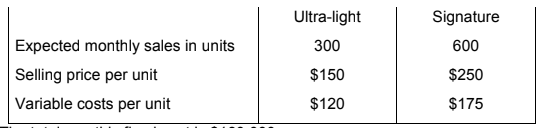

Dustbuster Ltd produces two models of hand-held cordless vacuum cleaners and the

monthly data on its two models follow:

The total monthly fixed cost is $180,000

Required:

1. Calculate the number of units of Ultra-light and Signature models that must be sold

to break even. (7 marks)

2. Without resorting to calculations, explain the impact (increase, decrease, no change) on the Dustbuster’s operating profit if the sales mix changes to 400 units of Ultra-light and 500 of Signature sold. Explain your answer. (3 marks)

3. Calculate the contribution margin ratio. (4 marks)

4. Calculate the total sales revenue required to break-even using the CM ratio

calculated in requirement 3. (2 marks)

Question 4 (7 marks)

Answer all parts of this mandatory question. If this question is omitted, there will be a

penalty of minus 5 marks (-5). Minimum 150 words.

1. What is your favourite topic(s) to date in the costing unit? Elaborate on why you like

the topic(s) (3.5 marks)

2. To date what topic(s) do you have difficulty with and why? Be specific about the

parts you are unable to grasp.